Originally published: March 20, 2025

This is the first post in a 5-part series about how to fix California’s energy problems. Today’s topic: How California is inflating gasoline prices.

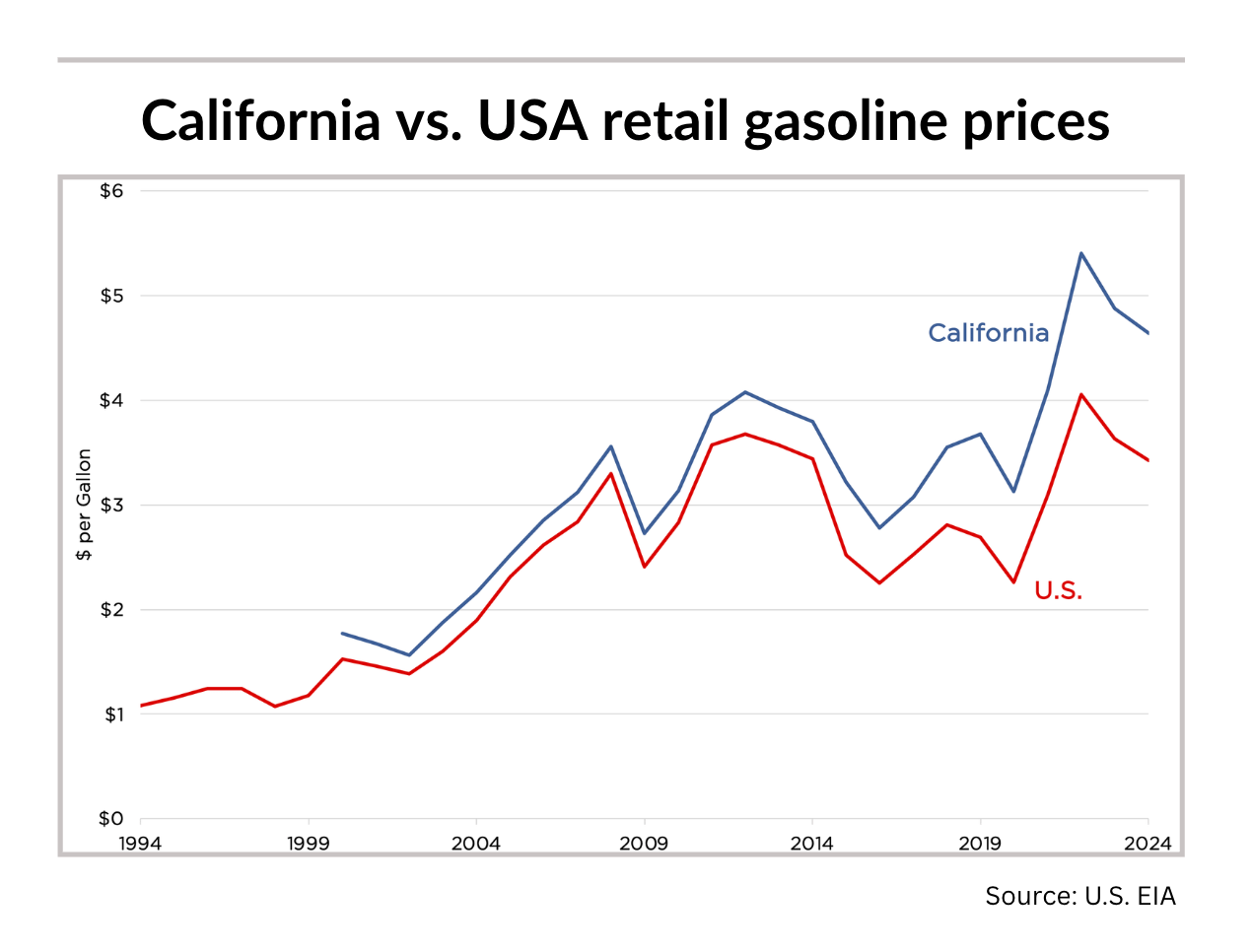

Why do we in California pay $1.50–$2.00 more for gas than other states?

It’s simple: anti-freedom, anti-fossil-fuel policies:

1) High excise taxes

2) Cap-and-trade carbon tax

3) Reformulated Gasoline mandate

4) Low Carbon Fuel Standard

5) “Summer Blend” fuel requirements

-

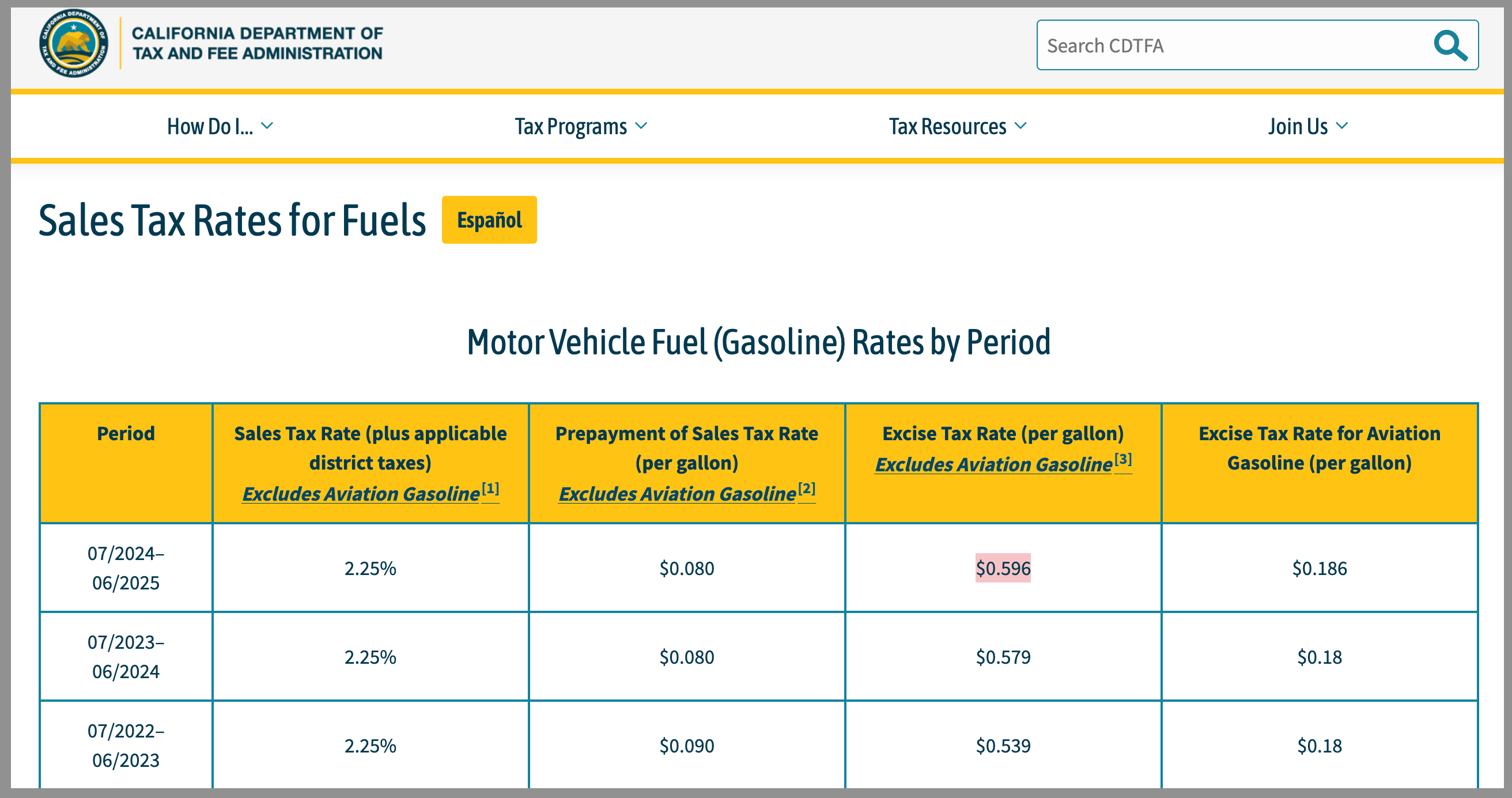

1. CA’s excise tax on gasoline adds $0.60 per gallon to the price of gasoline.

Why: The excise tax is a direct per-gallon tax on gasoline, which is added at the pump and passed directly to consumers.1

-

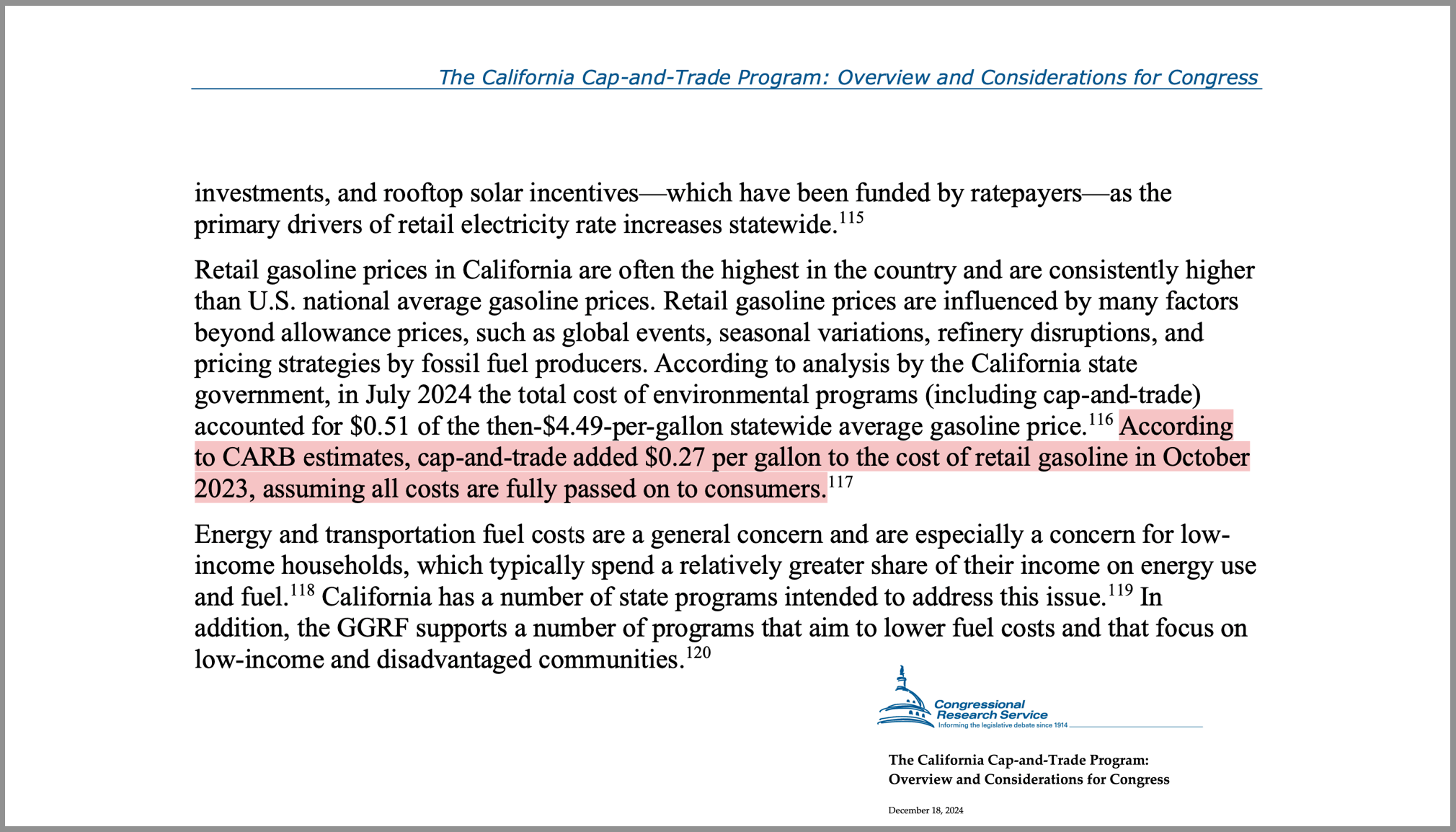

2. CA’s “cap-and-trade” carbon tax adds $0.27 per gallon to the price of gasoline.

Why: The “cap-and-trade” program forces fuel suppliers to buy emissions allowances for every gallon of gas they sell. That extra cost is ultimately passed to consumers.2

-

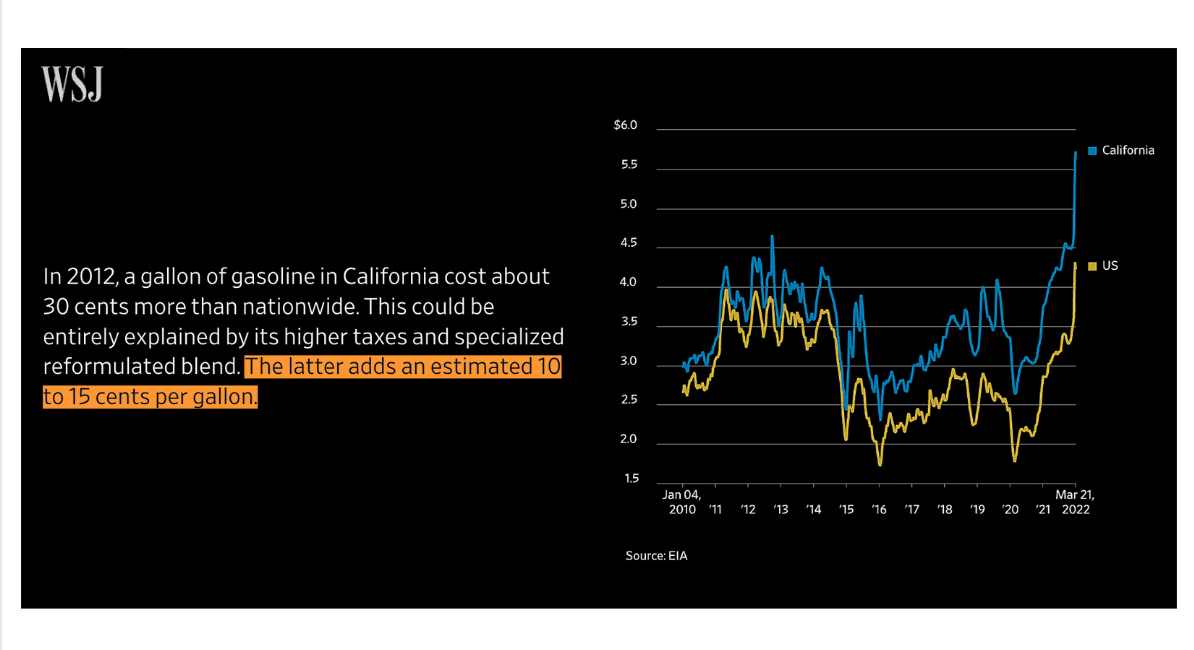

3. CA’s Reformulated Gasoline mandate adds 10-15 cents per gallon to the price of gasoline.

Why: The California Reformulated Gasoline mandate requires the production and use of a unique blend of gasoline subject to strict requirements, making it more expensive to refine.3

-

4. CA’s Low Carbon Fuel Standard is projected to add $0.37 per gallon to the price of gasoline in the near term—and $1.15 by 2046!

Why: Low Carbon Fuel Standard forces fuel producers to buy credits to offset their fuel's carbon intensity, driving up costs that are ultimately passed to consumers.4

-

5. CA’s “Summer Blend” fuel requirements add up to $0.15 per gallon to the price of gasoline during warmer months.

Why: The “Summer Blend” requires refiners to use a costly, low-volatility formula that is more expensive to refine and distribute, leading to higher fuel prices.5

-

The solution to California's gas prices is obvious: eliminate the 5 anti-fossil-fuel, anti-freedom policies that make prices so high.

Unfortunately, Governor Gavin Newsom wants to keep these policies and then scapegoat oil companies: “They've been fleecing you for decades and decades.”

-

Californians, unite: tell Governor Gavin Newsom and other California officials to make driving affordable again by eliminating high excise taxes, the “cap-and-trade” carbon tax, the “Reformulated Gasoline” mandate, the “Low Carbon Fuel Standard,” and “Summer Blend” fuel requirements.

Michelle Hung, Daniil Gorbatenko, and Steffen Henne contributed to this piece.

References

- California Department of Tax and Fee Administration - Sales Tax Rates for Fuels↩

- Congressional Research Service - The California Cap-and-Trade Program: Overview and Considerations for Congress↩

- WSJ - Breaking Down California’s ‘Mystery’ High Gas Prices↩

- California Air Resources Board - Low Carbon Fuel Standard SRIA, Standardized Regulatory Impact Assessment↩

- NACS - Seasonal Gas Prices Explained↩