ESG poses as a moral and financially savvy movement. In reality it is an immoral and financially ruinous movement that is destroying the free world's ability to produce low-cost, reliable energy. This prevents poor countries from developing and threatens America's security.

ESG’s ignoble rise to dominance

-

Over the last 5-10 years, "ESG"--standing for Environmental Social Governance--has gone from an acronym that virtually no one knew or cared about, to a cultishly-embraced top priority of financial regulators, markets, and institutions around the world.

-

The preposterous financial pretense of "ESG investing" is that the promoters of it have so accurately identified universal norms of long-term value creation--Environmental norms, Social norms, and Governance norms--that imposing those norms on every company is justified.

-

In reality, ESG was a movement cooked up at the UN--not exactly a leading expert in profitable investment--to impose moral and political agendas, largely left-wing ones, on institutions that would not adopt them if left to their own devices.1

-

The number one practical policy advocated by the ESG movement today is: divest from fossil fuels in every way possible, and associate yourself with "renewable" solar and wind in every way possible. This policy is helping destroy energy production around the world.

ESG’s immoral energy policy

-

Divesting from fossil fuels is immoral because: 1. The world needs much more energy. 2. Fossil fuels are the only way to provide most of that energy for the foreseeable future. 3. Any problems associated with CO2 pale in comparison to problems of energy deprivation.

-

The world needs much more energy

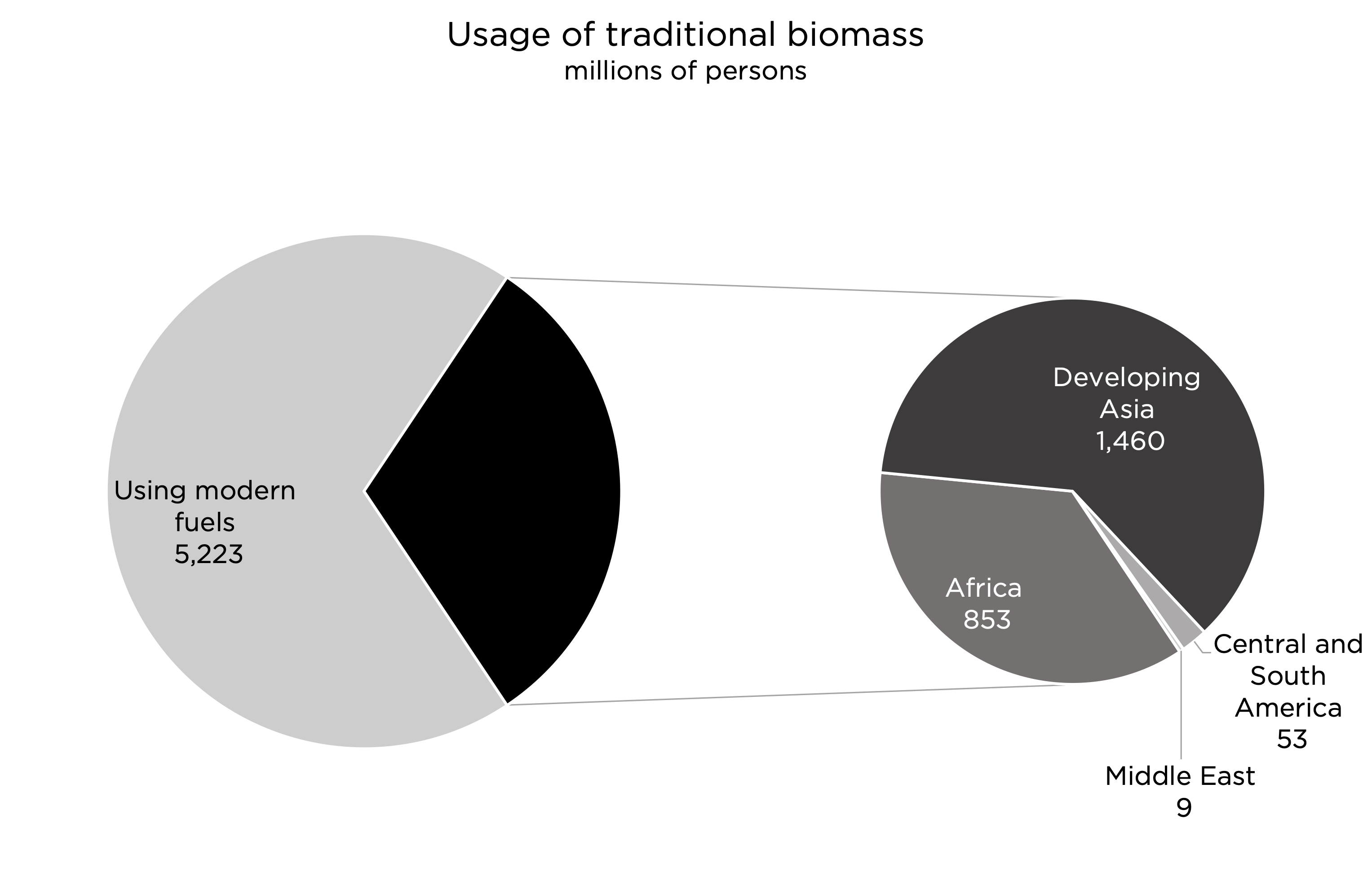

Low-cost, reliable energy enables human beings to use modern machines to be productive and prosperous. Yet 3 billion people still use less electricity than a typical American refrigerator. 2.6 billion people are still using wood or dung for heating and cooking.2

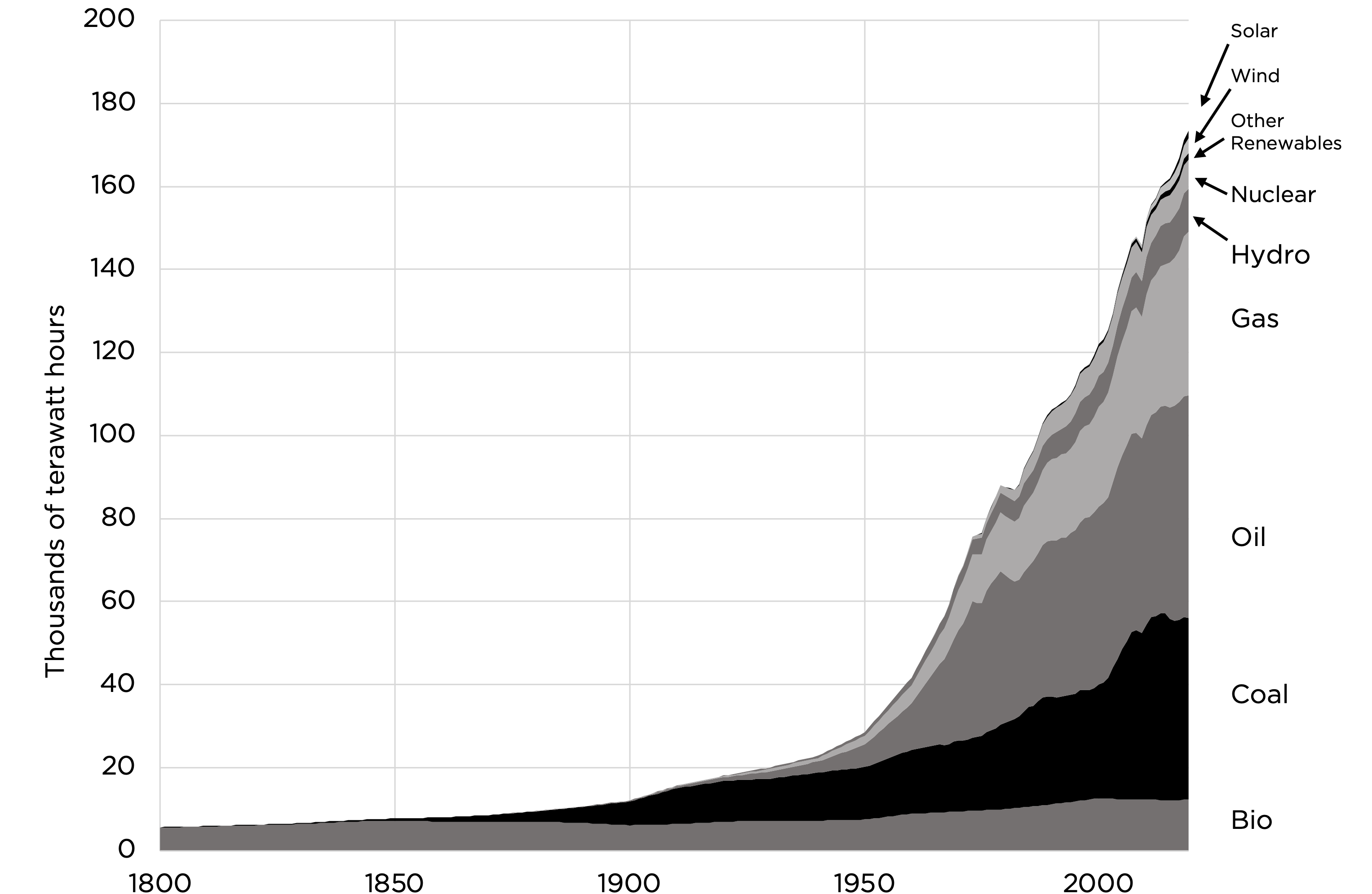

- Fossil fuels are indispensable Only fossil fuels provide low-cost, reliable, versatile, global-scale energy. Unreliable solar and wind can't come close. That's why fossil fuels continue to grow in the developing world; China and India have hundreds of coal plants in development.3

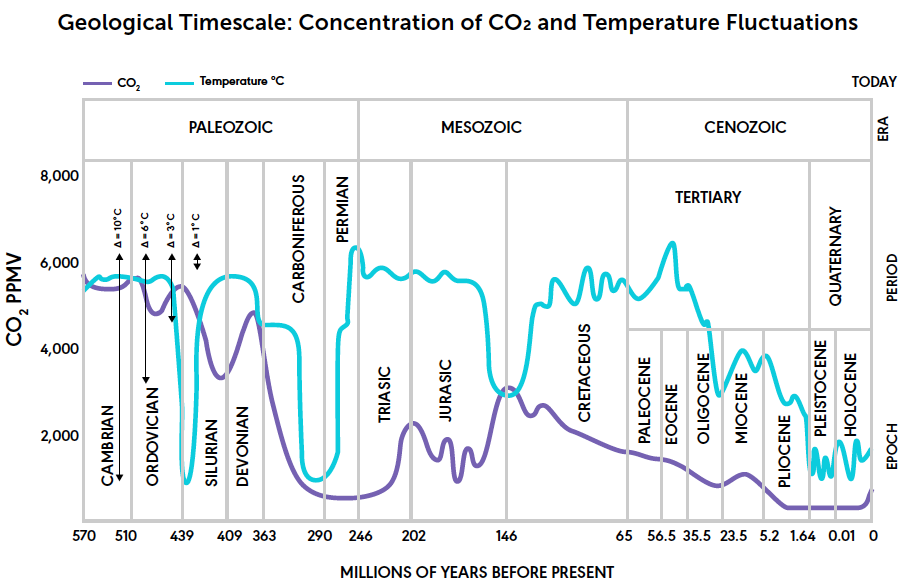

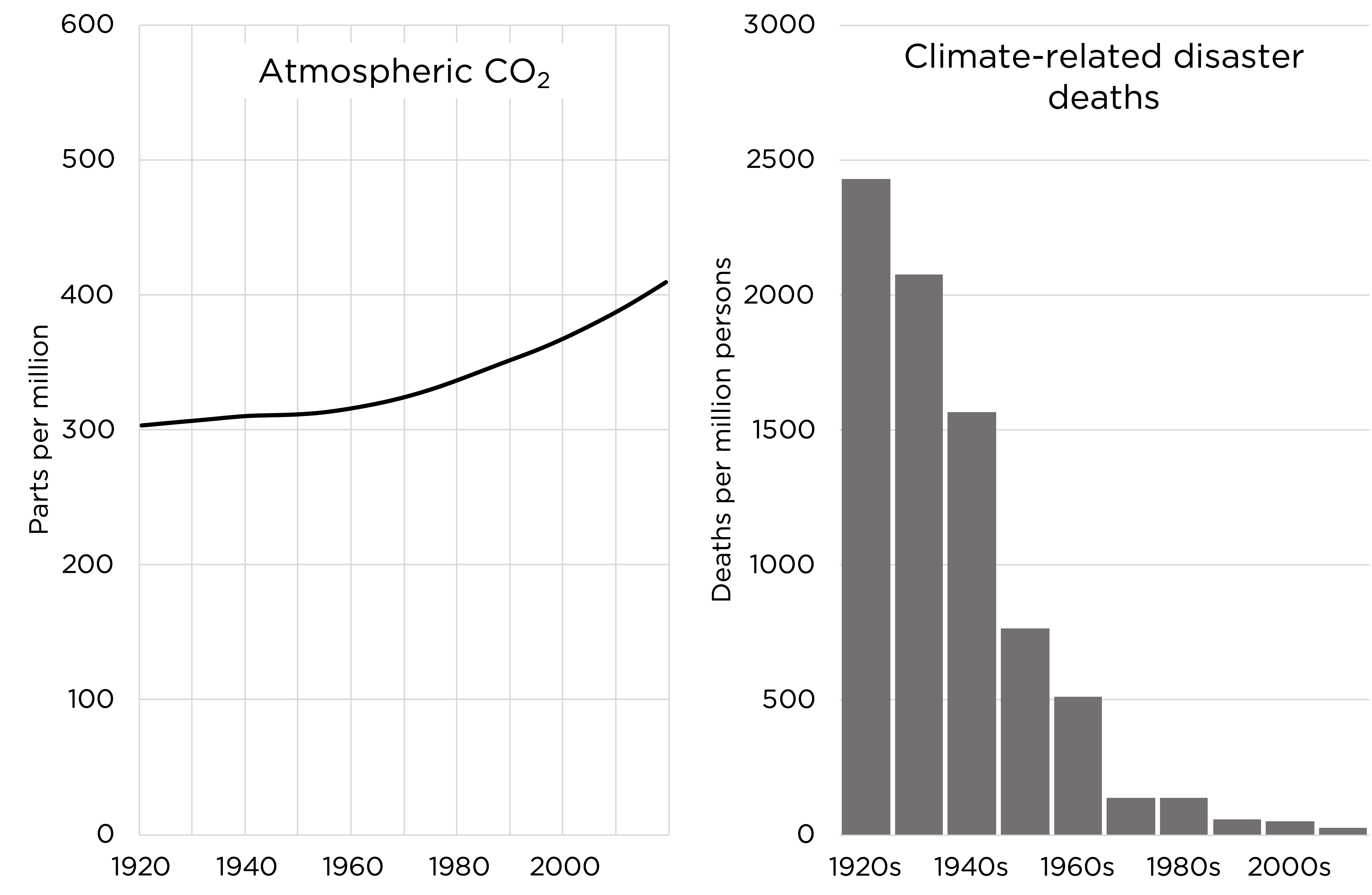

- CO2 levels matter much less than energy availability, 1 CO2 emissions have contributed to the warming of the last 170 years, but that warming has been minor and masterable—1 degree C, mostly in cold parts of the world. And life on Earth thrived when CO2 levels were >5X today's.4

- CO2 levels matter much less than energy availability, 2 Fossil fuels have made climate far safer by powering a highly resilient civilization. That's why climate disaster deaths—from extreme temperatures, droughts, wildfires, storms, and floods—have decreased 98% over the last century.5

How ESG makes energy more expensive, which makes everything more expensive.

-

A moral financial movement would eagerly seek to to increase capital for all cost-effective energy, including fossil fuels. Instead, ESG is starving cost-effective energy of capital by pressuring companies to divest themselves of the fossil fuels the world desperately needs.

-

The ESG movement is a major cause of oil and gas investment declining dramatically, leading to unnecessarily high prices. Between 2011 and 2021, oil and gas exploration investments declined by 50%. Less investment = less supply = higher prices.6

-

By starving cost-effective energy of capital, the ESG movement is engaging in a fundamental act of mass destruction. Energy is the industry that powers every other industry. By making energy more expensive, ESG makes everything more expensive--hurting the poorest people most.7

How ESG harms the poor most of all

- The most egregious immorality of the ESG movement, led by Larry Fink's Blackrock, is its effort to destroy vital fossil fuel projects in poor places that desperately need them. This effort is guaranteed to perpetuate poverty.8

-

Example of ESG poverty perpetuation: South Korea canceled new coal plants in South Africa and the Philippines after "Global investors including Blackrock...warned the South Korean utility to drop coal power projects."9

-

Another example of ESG poverty perpetuation: "International investors are increasingly restricting support to companies involved in extracting or consuming coal, yet nearly 70% of India’s electricity comes from coal plants, and demand for power is set to rise..."10

-

ESG poverty perpetuation is getting worse as activist "investors" with increasing influence on large financial institutions try to stop all fossil fuel projects in poor places. E.g., HSBC was attacked when it decided to fund 6 new coal power plants in Indonesia and Vietnam.11

-

ESG defunding fossil fuel projects in the poorest parts of the world will mean: more babies die for lack of incubators and other medical equipment, more deaths from lack of water treatment plants and modern sanitation, more deaths from lack of heating and air-conditioning.

-

Every leading ESG institution should be called out for their genocidal policies toward the poorest parts of the world. They should be shamed for placing their own virtue-signaling above billions of actual human lives. They should lose all moral authority in the realm of energy.

How ESG harms the security of the free world

-

The ESG movement is also an enormous threat to the security of the free world, because by depriving free countries and poor countries of low-cost, reliable energy, it furthers Communist China's ambitions to become the world's superpower using low-cost, reliable fossil fuels.

-

China has a clear strategy of running its economy on fossil fuels, while encouraging others to run on inferior, unreliable solar and wind — that is made using Chinese fossil fuels, which produce 85% of Chinese energy. China has 247 GW of coal plants (3 TX's worth) in development.12

-

China dominates the mining and processing of "renewable" materials to a staggering degree. The US does little mining or processing of the needed materials, largely because of "green" regulations. Our dependence on China for "renewables" dwarfs past Mideast oil dependence.13

-

Energy security is national security. When hostile foreign powers can meaningfully cut off our access to energy they can manipulate us politically. Examples: US appeasement of Saudi Arabia and European appeasement of Russia.

-

Energy security is national security, above all in wartime. War requires continuous high-energy manufacturing and continuous fueling of high-energy mobile machines such as planes and tanks. Both world wars were won by the side with the most oil, the fuel of mobility.

-

What does the modern ESG movement do about the danger of an energy-dominant China? Deny reality and serve as "useful idiots." Example: Larry Fink's sole mention of China in his influential letter to CEOs was to praise China's "historic commitments to achieve net zero emissions"!14

Why the ESG divestment movement must be condemned and replaced

-

The ESG divestment movement should be publicly shamed as a virtue-signaling, financially idiotic, and most importantly immoral movement that perpetuates poverty and threatens freedom. All legal pressures to adopt it should be eliminated. ESG should be boycotted wherever possible.

-

The anti-energy, anti-freedom ESG movement should be replaced with a voluntary long-term value creation movement. Creating sustained value for companies' owners requires a long-term perspective. But a long-term perspective means valuing cost-effective energy, not destroying it.

References

- Betsy Atkins - Demystifying ESG: Its History & Current Status

UNPRI↩ - Alex Epstein - Congressional testimony for May 19, 2021↩

- As of July 2021, China and India are planning or constructing over 280 new coal-fired power plants with a combined capacity of over 300 GW.

Global energy Monitor - Global Coal Plant Tracker↩ - Alex Epstein - Talking Points on the So-Called Climate Crisis

“The best estimate of CO2 concentration in the global atmosphere 540 million years ago is 7,000 ppm, with a wide margin of error.”

Patrick Moore - THE POSITIVE IMPACT OF HUMAN CO2 EMISSIONS ON THE SURVIVAL OF LIFE ON EARTH

NOAA - Climate change rule of thumb: cold "things" warming faster than warm things↩ - For every million people on earth, annual deaths from climate-related causes (extreme temperature, drought, flood, storms, wildfires) declined 98%—from an average of 247 per year during the 1920s to 2.5 in per year during the 2010s.

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates for the 1920s from the Maddison Database 2010 come from the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen. For years not shown, the population is assumed to have grown at a steady rate.Latest population estimates from World Bank Data. Maddison Database 2010

World Bank Data

Bjorn Lomborg - Welfare in the 21st century: Increasing development, reducing inequality, the impact of climate change, and the cost of climate policies↩ - Financial Times - Embrace high fossil fuel prices because they are here to stay

Michael Shellenberger - How Climate Activists Caused the Global Energy Crisis↩ - Alex Epstein - Talking Points on Energy Poverty↩

- Meme circulating on Twitter↩

- Power Engineering International↩

- ETBFSI - Indian banks do balancing act between green commitments and coal financing↩

- ESGClarity - HSBC feels the heat for financing coal plants↩

- China’s primary energy consumption from coal, oil, and natural gas was over 85% of the total in 2019.

BP Statistical Review of World Energy 2021

David Wojick - CHINA LOVES COAL FAR MORE THAN WIND

WSJ - Global Coal Power Expected to Hit Record Despite Climate Fight

WSJ - Behind the Rise of U.S. Solar Power, a Mountain of Chinese Coal

WSJ - How to Add Gas to U.S.-China Climate Cooperation↩ - China has a tight grip on many critical minerals in the rare earth category, controlling the mining of a large share and processing of close to 100% of them.

Power Hour - Maxwell Goldberg on Our Dangerous Material Dependence on China

Investingnews.com - 10 Top Countries for Rare Earth Metal Production

Defensenews.com - The collapse of American rare earth mining — and lessons learned

Alex Epstein - Talking Points on how the Biden Administration threatens energy security↩ - Larry Fink's 2021 letter to CEOs↩