Originally published on May 16, 2023

Myth: Fossil fuels would be used much less were it not for the disproportionately large subsidies they receive.

Truth: Fossil fuels would be used considerably more were it not for the disproportionately large government punishments that they receive.

-

Fossil fuel attackers claim that fossil fuels are disproportionately subsidized by the US and other governments, and therefore new fossil fuel restrictions and solar and wind subsidies only level the playing field. If not for huge fossil fuels subsidies, they say, we’d rapidly stop using them.

-

The view that outrageous fossil fuels subsidies are holding us back was epitomized by Senator Whitehouse’s recent statement that fossil fuels subsidies and lobbyists who support them are “why we can’t have nice things like clean air, safe coral reefs, secure coastlines, and affordable clean energy.”1

-

Politicians and media share fossil fuel “subsidy” numbers like over $5 trillion annual subsidies globally and over $600 billion for the US. Both numbers are promoted widely by the International Monetary Fund.

But just simple math and common sense reveal these numbers to be absurd.2

-

Simple math

In 2022, the world used ~$3.7 trillion worth of oil (avg $100/barrel).

If fossil fuels get $5.9 trillion in subsidies, oil—37% of fossil fuel use—should get $2.2 trillion, which means ~$60/barrel!

We are to believe governments are paying oil companies the equivalent of $1.40/gallon of gas??!!

-

Common sense

If fossil fuels’ dominance was based on subsidies, it would only be in places with ample fossil fuel resources, because only they have any incentive to subsidize.

But fossil fuels dominate in places with no fossil fuel resources, like Japan.

Only conspiracy believers could attribute this to subsidies.

-

Unfortunately, even though claims about fossil fuels dominating because of trillions in subsidies defy simple math and common sense, they are very popular due to 6 fallacies that are widely used and rarely refuted.

Here’s an explanation and refutation of each fallacy. 👇

-

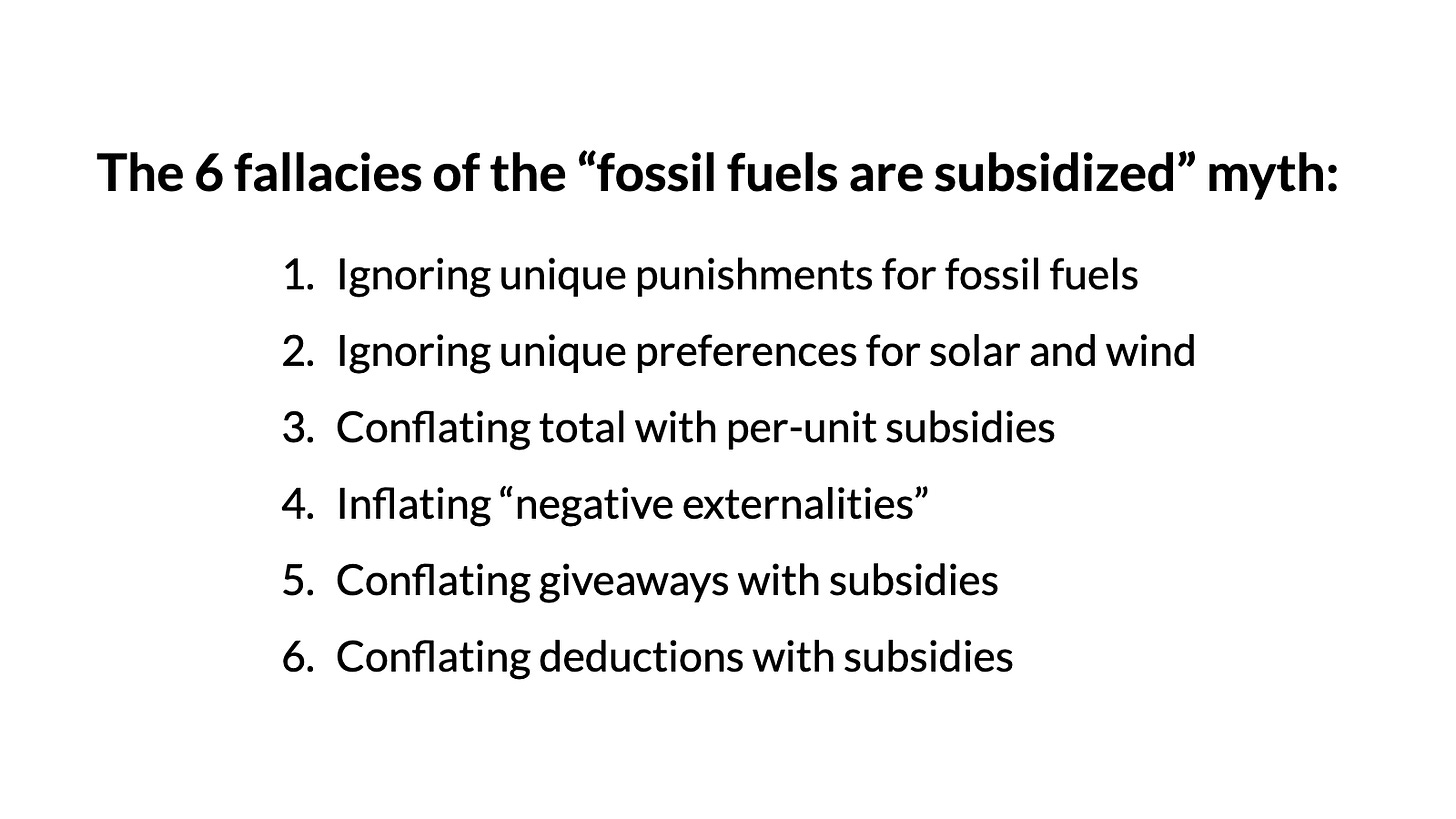

6 fallacies of the fossil fuel subsidies myth:

- Ignoring unique punishments for fossil fuels

- Ignoring unique preferences for solar and wind

- Conflating total with per-unit subsidies

- Inflating “negative externalities”

- Conflating giveaways with subsidies

- Conflating deductions with subsidies

-

Fallacy 1: Ignoring unique punishments for fossil fuels

Claims that fossil fuels are disproportionately subsidized totally ignore the completely unrivaled, ruinous, and costly punishments that governments place on fossil fuel investment, production, transport, and refining.

-

The idea we should rapidly eliminate fossil fuel use is literally the leading political idea in the world, which manifests in “whole of government” punishments of fossil fuels in the US and many other countries.

But critics of fossil fuels subsidies pretend these costly punishments don’t exist!

-

The costs of punishing fossil fuel investment

Fossil fuels investments are long-term commitments that require confidence in a payoff. Governments, often colluding with activists, incessantly discourage fossil fuel (and only fossil fuel) investments directly and by threatening the industry’s future.

-

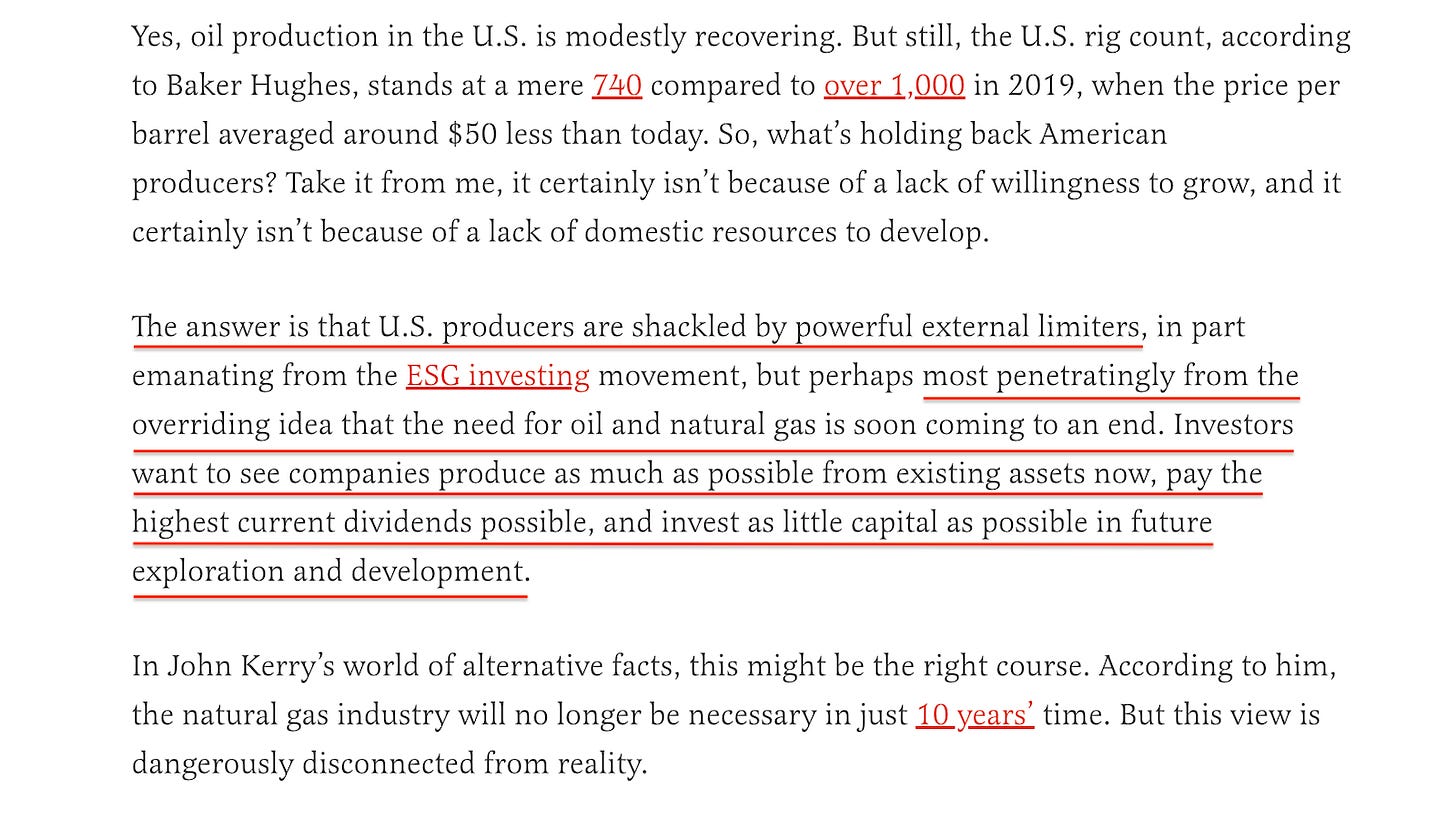

The Federal government has been a major driver of ESG anti-fossil-fuel climate policies, with regulators pressuring financial institutions to declare their commitment to getting off fossil fuels. The SEC’s recent “climate disclosure rules” are taking the damage to the next level.3

-

ESG Larry Fink, in his 2021 Letter to CEOs, explained the scope of punishment that the government-supported ESG movement seeks to specifically inflict on fossil fuels by pursuing “net zero” by 2050: “emissions need to decline by 8-10% annually between 2020 and 2050.”4

-

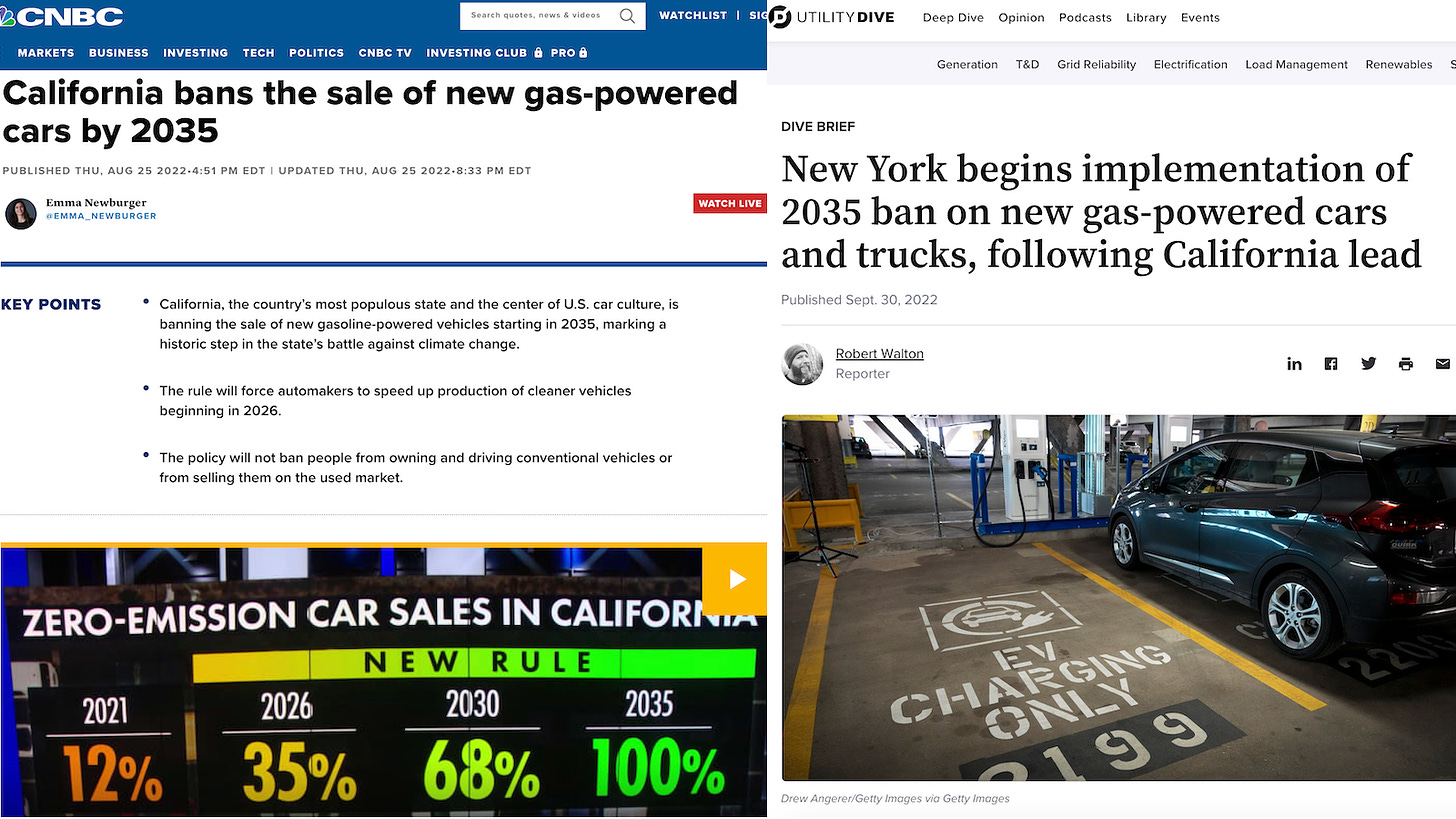

Another major and unique punishment for fossil fuel investment is the many planned bans on oil-powered cars and trucks by 2035, such as in California and New York. These planned bans tell investors: don’t invest in oil because we are going to do our best to make your investment fail.5

-

The greatest threat fossil fuel investment faces is the overall global net-zero agenda because it is a commitment to ban the vast majority of fossil fuel use in the next few decades. E.g., when Joe Biden vows to “end fossil fuel” and then becomes President, investors run.6

-

Last year the successful oil executive Cody Campbell wrote an article, “Yes, Biden’s War On The Oil And Gas Industry Is Driving Shortages And High Prices,” citing the idea that “the need for oil and natural gas is soon coming to an end.”

No non-fossil-fuel industry is punished this way.7

-

The costs of punishing fossil fuel production

Punishing restrictions and onerous taxes specifically on fossil fuel production are common in developed countries, suppressing supply from the freest nations on the globe.

Yet critics of “fossil fuels subsidies” pretend these punishments don’t exist.

-

Far from giving the fossil fuel industry the disproportionate preference claimed by critics of “fossil fuel subsidies,” Europe has systematically banned fracking, the tech that turned the US into a dominant player in oil and gas over the last 10+ years.8 https://twitter.com/AlexEpstein/status/1445452600745234434

-

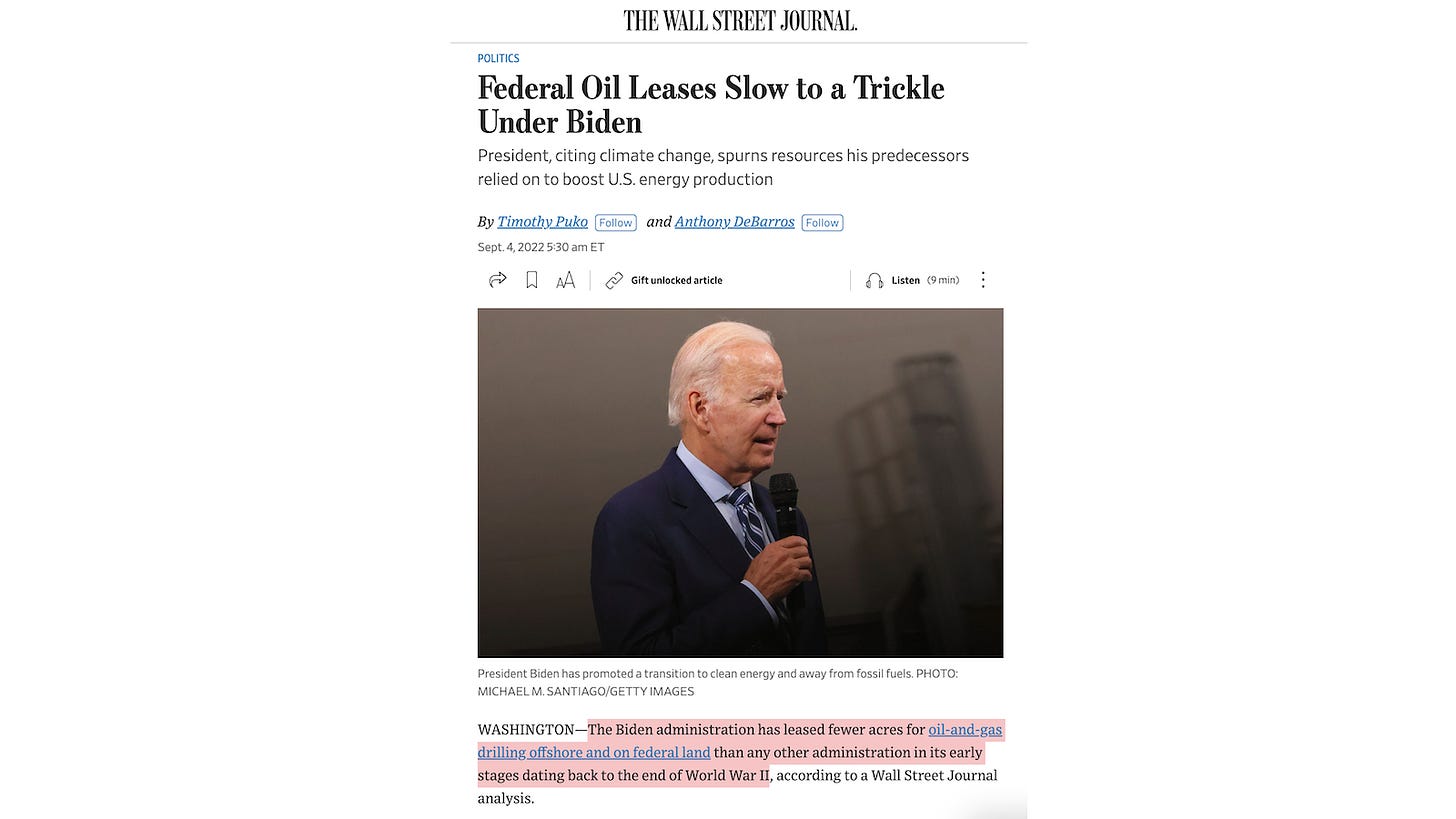

One of the many unique punishments President Biden has inflicted on the supposedly-preferred fossil fuel industry was his early moratorium on issuing oil & gas leases on Federal lands. And the Biden admin continues to delay and decline holding lease sales.9

-

The costs of punishing fossil fuel transport

One of the most effective ways of punishing the fossil fuel industry, and only the fossil fuel industry, has been attacking critical transport infrastructure, including pipelines and export/import facilities, with delays, regulations, and lawsuits.

-

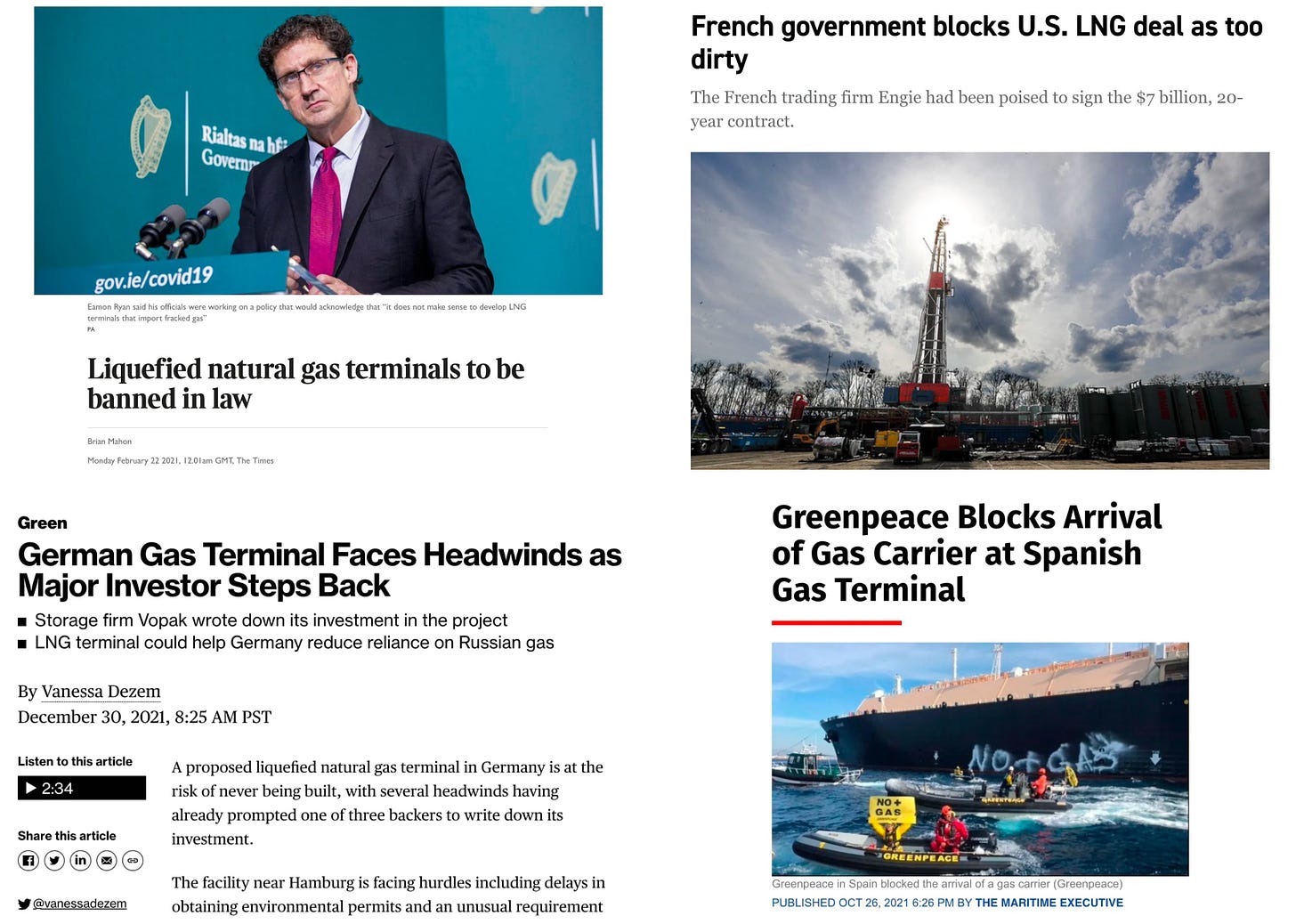

A major cause of Europe’s current energy impotence is its longtime opposition to LNG (Liquefied Natural Gas) import terminals—combined with the US’s opposition to export terminals.

Yet critics of alleged fossil fuel favoritism ignore this kind of unique and massive punishment.10

-

Biden’s destruction of the Keystone XL pipeline inhibited Canada from bringing oil to market, which prevents Canada from using its vast oil deposits to their full potential—meaning lower global supply and higher prices for oil.11

-

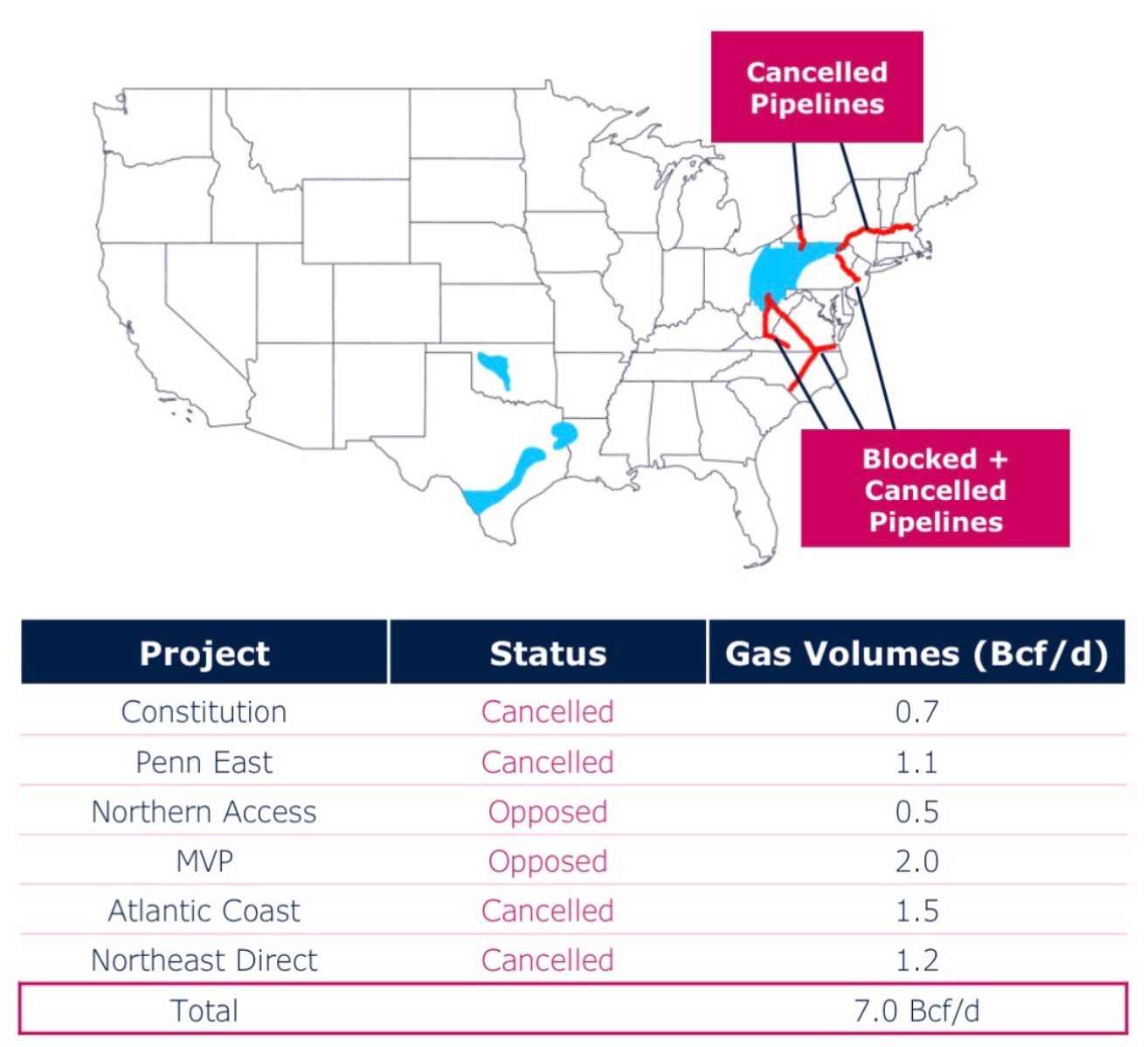

Perhaps our most destructive way of singling out fossil fuel transport for punishment has been killing natural gas pipelines.

We have a virtually limitless supply of gas and an incredible ability to ramp up production.

But we’re blocking pipeline after pipeline—such as these 6.12

-

The costs of punishing fossil fuel refining

Another way in which the fossil fuel industry gets singled out for punishment is through numerous, costly attacks on its freedom to refine oil—while the processing of solar and wind components gets a free pass to pollute in developing countries.13

-

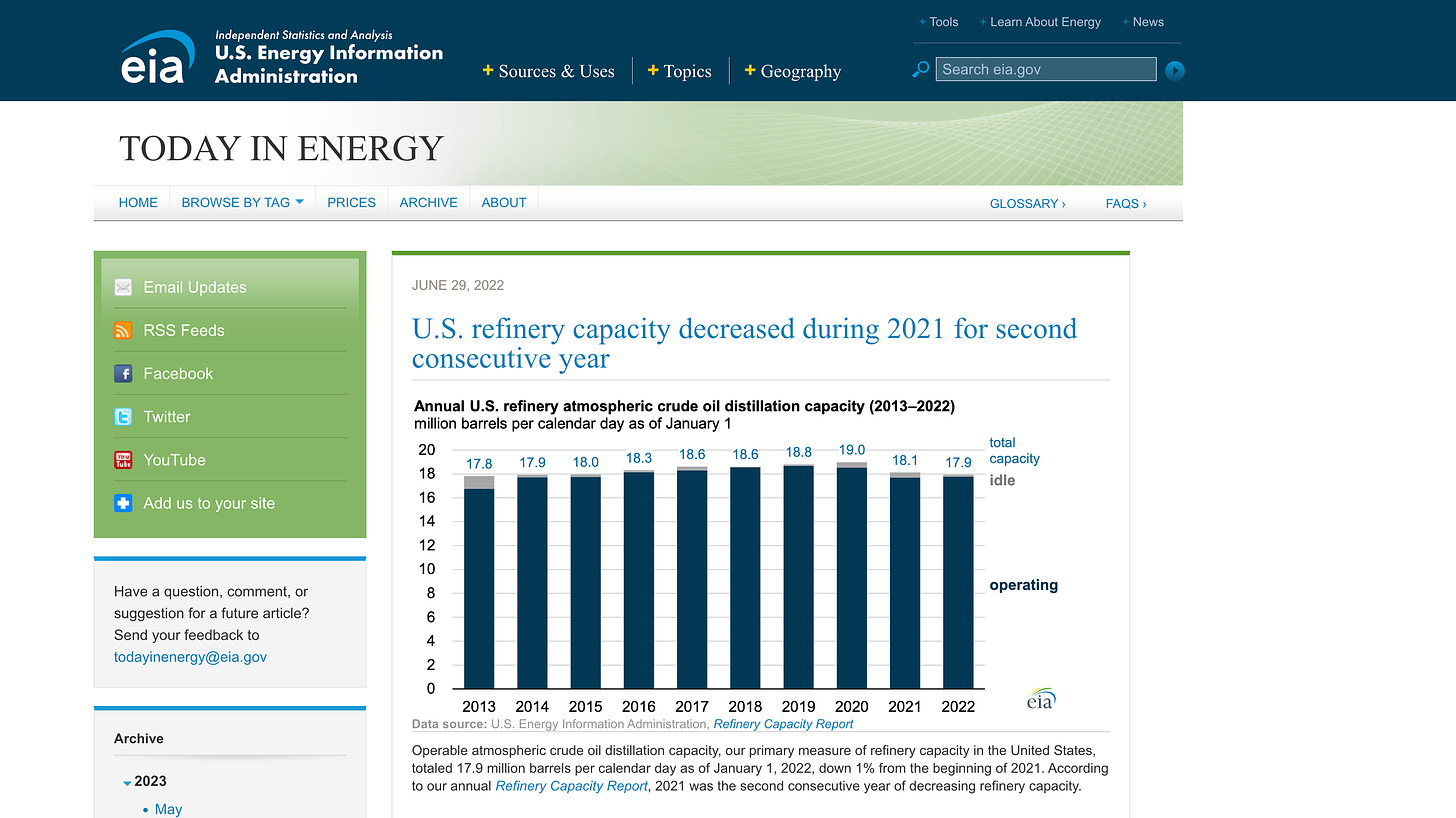

Given that oil demand is increasing and that US oil production has increased, you’d expect US refining capacity to have rapidly expanded. Instead, it has stagnated and even recently declined thanks to an increasingly hostile regulatory environment.14

-

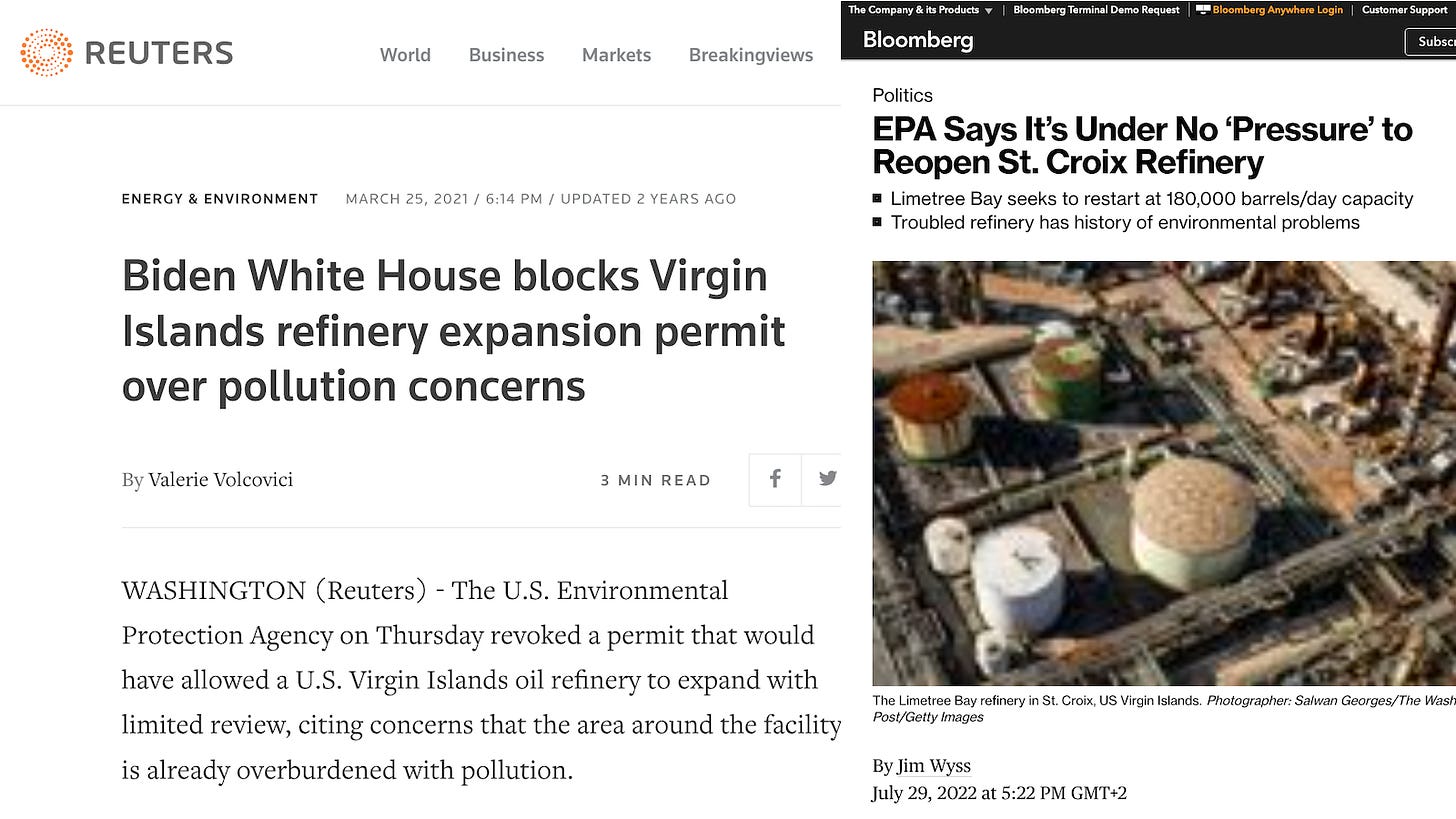

In 2021, the Biden administration shut down a Virgin Islands refinery. Instead of working with the operator to upgrade the refinery amidst the looming fuel shortage, the Biden EPA prevented the refinery’s 180,000 barrels/day capacity—which had the potential to expand to 450,00015

-

One way oil refiners get singled out for punishment is via threats of “windfall profits” taxes. Refining is a tough business, often with tiny margins. Yet when refiners succeed they face “windfall profits” taxes that no solar or wind company ever has to worry about.16

-

European politicians implemented a windfall profit tax of 33% on refiners who had seen much higher profits due to high fuel prices. But the effect was to further disincentivize investment in sufficient refining capacity.17

-

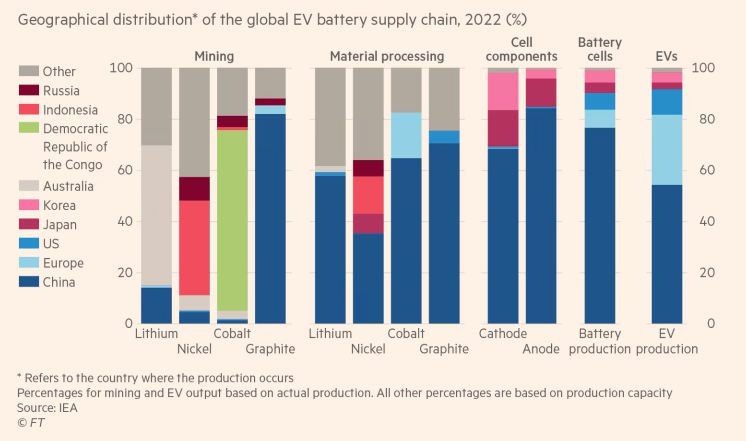

While oil refining in developed countries is under costly scrutiny for low levels of pollution, the significant negative health effects of mining and refining critical materials for “green” energy in poor countries largely get a pass. Another instance of punishing only fossil fuels.

-

The disproportionate tax burden

Another disproportionate punishment of allegedly subsidized fossil fuels is the high tax burden along the supply chain they face in many countries but particularly Western countries like the US. Overall fossil fuels pay far more taxes than the competition.

-

Last year, the Biden administration hiked the royalty rate for new oil leases by 50%. This is money the government gets on top of the regular taxes on business activity by the industry. And it diminishes the profitability of US oil investments.18

-

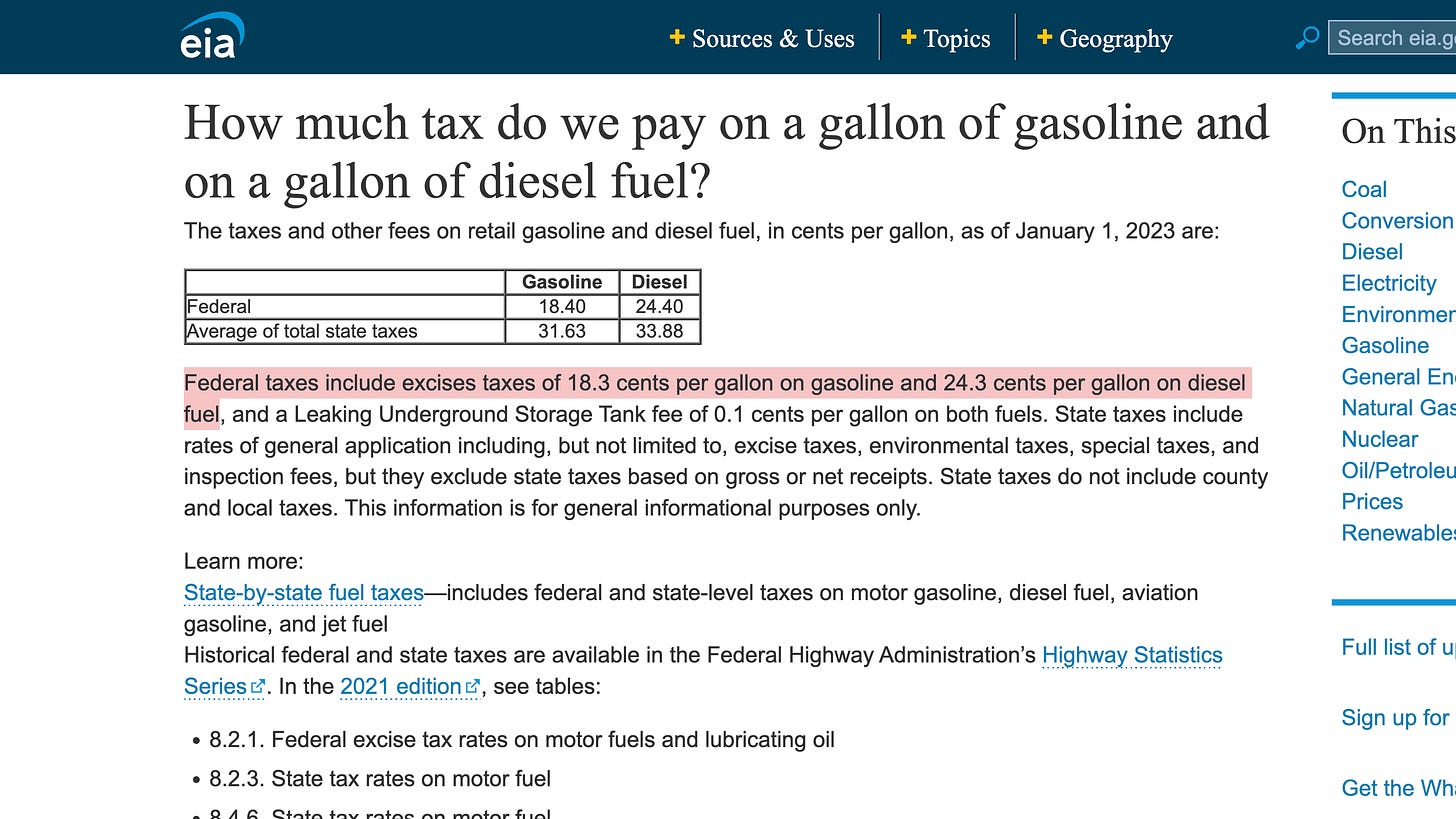

Gasoline taxes are just one tax that has no equivalent in non-fossil-fuel energy industry. E.g., in California, just the excise tax is 54 ¢/gallon of gasoline. On average, the extra federal and state taxes on oil-derived fuel is in excess of 50 ¢/gallon. There is no comparable tax for EVs.19

-

Given the truly huge costs of the unique punishments that governments impose on the fossil fuel industry—punishing fossil fuel investment, production, transport, and refining, while also imposing more taxes—it is deeply dishonest for the “fossil fuels are subsidized” crowd to ignore these costs.

-

The only energy industry that can compete with fossil fuels for amount of unique punishment it gets is the nuclear industry. Thanks to irrational regulations, nuclear is virtually criminalized, which leads to incredible costs.

Yet nuclear, too, gets dismissed as “subsidized.”

-

Fallacy 2: Ignoring unique preferences for solar and wind

Claims that fossil fuels are disproportionately subsidized ignore the unique preferences given to alternatives, above all to solar and wind—which get unrivaled subsidies as well as preferences that are even more significant.

-

The unique preferences given to solar and wind include:

-

No price penalty for unreliability

-

Subsidies to generators

-

Subsidies for supporting infrastructure

-

Literal mandates

-

-

Solar and wind preference: no price penalty for unreliability

In every area of life, we pay far more for a reliable service than for an unreliable one. But in electricity, unfair rules make utilities pay the same prices for unreliable solar and wind electricity as they do for reliables.

-

Solar and wind preference: Subsidies to generators

Subsidies for unreliable electricity, above all the Investment Tax Credit and the Production Tax Credit, force taxpayers to pay utilities to slow down or shut down reliable power plants whenever the sun shines or the wind blows.

-

Solar and wind preference: Subsidies for supporting infrastructure

Solar and wind are subsidized by socializing the costs of unreliability, such as additional transmission lines or storage batteries. This subsidy further rewards unreliable electricity at the expense of fossil fuels.

-

Solar and wind preference: Literal mandates for solar and wind

Many governments literally mandate that a certain percentage of electricity come from solar and wind. This is the ultimate government favoritism, yet it’s ignored by attackers of “fossil fuel subsidies.”

-

Fallacy 3: Conflating total with per-unit subsidies

When critics of “fossil fuel subsidies” aren’t 100% ignoring the subsidies of solar and wind, they try to make them seem small by comparing them to the total (alleged) subsidies of fossil fuels—which generate multiple times the energy.

-

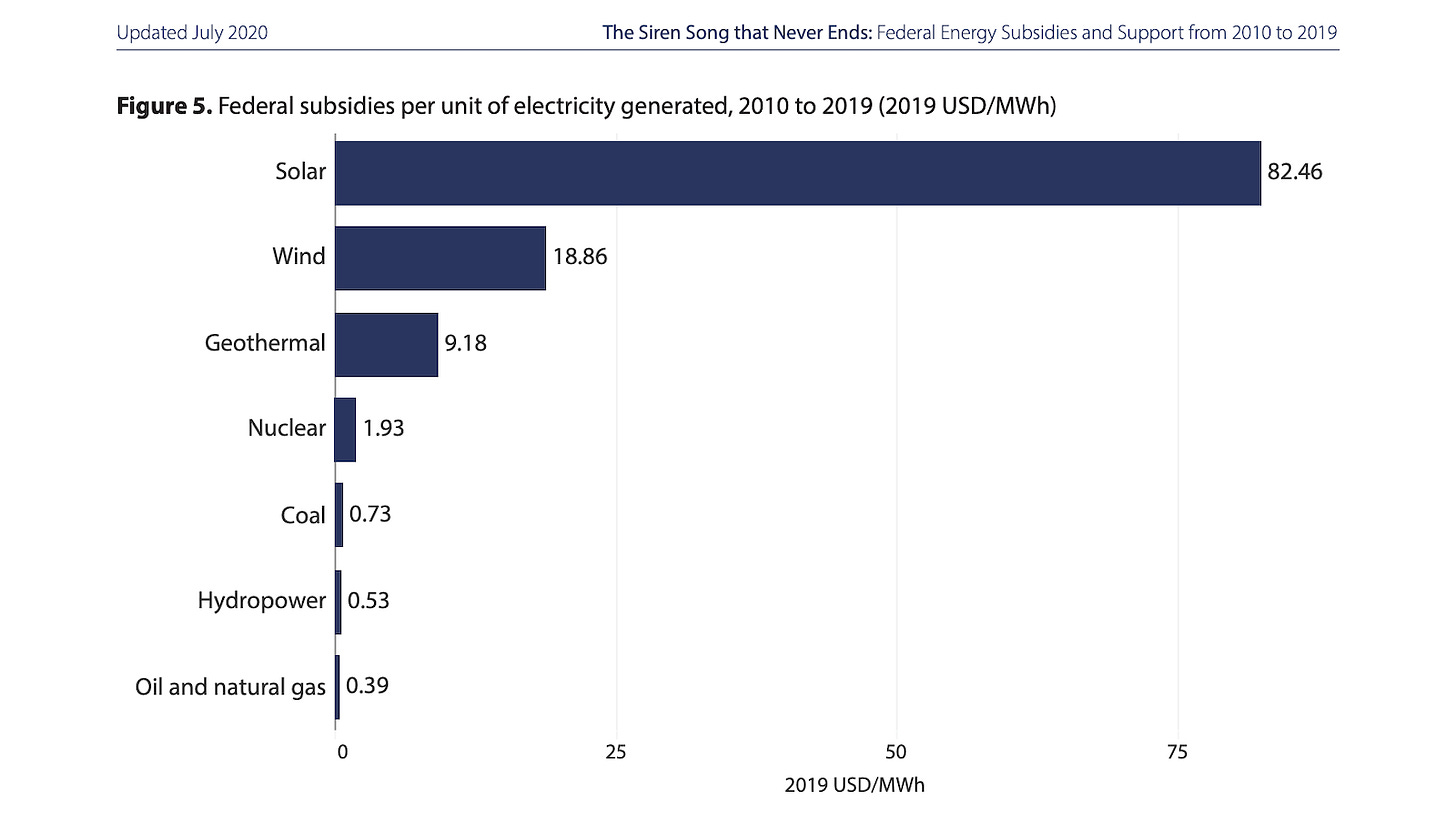

The proper way to measure energy subsidies is: How much taxpayer money does the government pay per unit of energy? Every per-unit analysis using data from the US Energy Information Administration is clear: solar and wind get dozens of times more subsidies than fossil fuels.20

-

Claims that fossil fuels get more subsidies than solar and wind use “total subsidies,” not per-unit subsidies. By that logic, Walmart is more expensive than Nordstrom because Walmart takes in more total money. (No store, including Nordstrom, charges the crazy markup that solar and wind get.)

-

A comprehensive analysis of federal subsidies per unit of electricity generated from 2010-2019 found that solar got 211 times more subsidies than natural gas and wind got 48 times more subsidies than natural gas.21

-

Remember, big solar and wind subsidies are just a fraction of the preferences they get, which include:

-

No price penalty for solar and wind's costly unreliability

-

Mandates that force us to pay for solar panels, wind turbines, and long-distance transmission lines, regardless of cost

-

-

Given that the fossil fuel industry is uniquely punished by governments around the world, at stratospheric cost, while solar and wind is uniquely rewarded—with higher subsidies being just one preference—it is a remarkable feat of evasion to claim that fossil fuels succeed due to subsidies.

-

Fallacy 4: Inflating negative externalities

The claim that fossil fuels’ “externalities” aren’t sufficiently taxed

- hugely inflates negative externalities and

- ignores a) the huge tax of anti-FF policies and b) positive externalities

-

Hugely inflating "negative externalities"

Claims that fossil fuels have multi-trillion dollar subsidies for fossil fuels are based on claiming huge “negative externalities” regarding climate and human health even though fossil fuels have improved climate safety and human health.

-

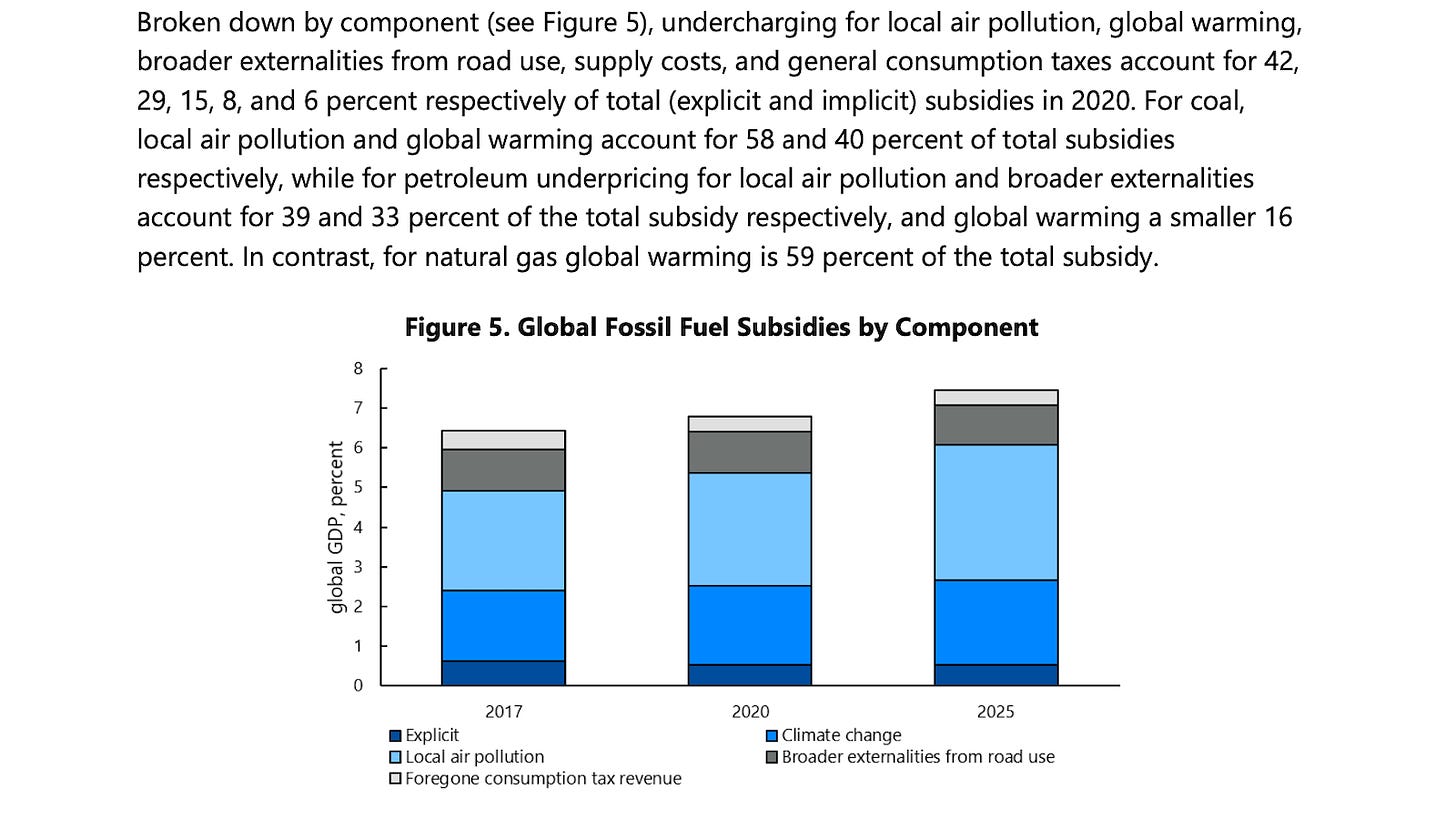

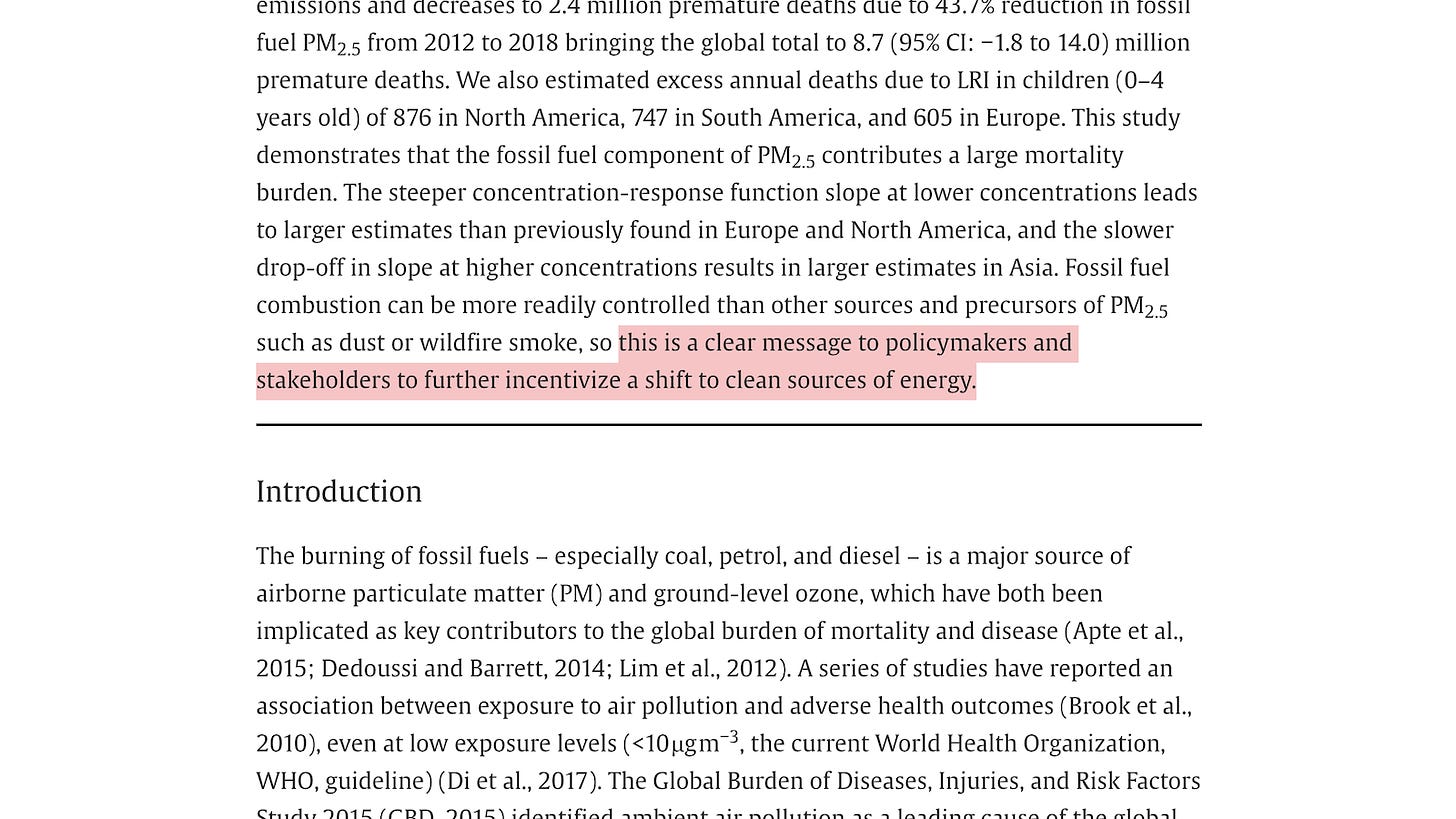

When you see claims of enormous “fossil fuel subsidies,” such as the International Monetary Fund’s (IMF) current claim that fossil fuels get $5.9 trillion in subsidies, those numbers come overwhelmingly from calculations of enormous “negative externalities” from fossil fuel greenhouse gas emissions and air pollution.22

-

If you want to quickly gauge the credibility of the IMF as an unbiased calculator of subsidies, note that a significant portion of what they call “fossil fuel subsidies” is from “Broader externalities from road use.” They are blaming fossil fuels for traffic accidents!

-

Hugely inflating negative climate impacts

Claims of multi-trillion dollar subsidies for fossil fuels, to be “corrected” by multi-trillion dollar taxes on fossil fuels, are based on the goal of keeping warming below 2°C from preindustrial times.

But this is an arbitrary and destructive goal.23

-

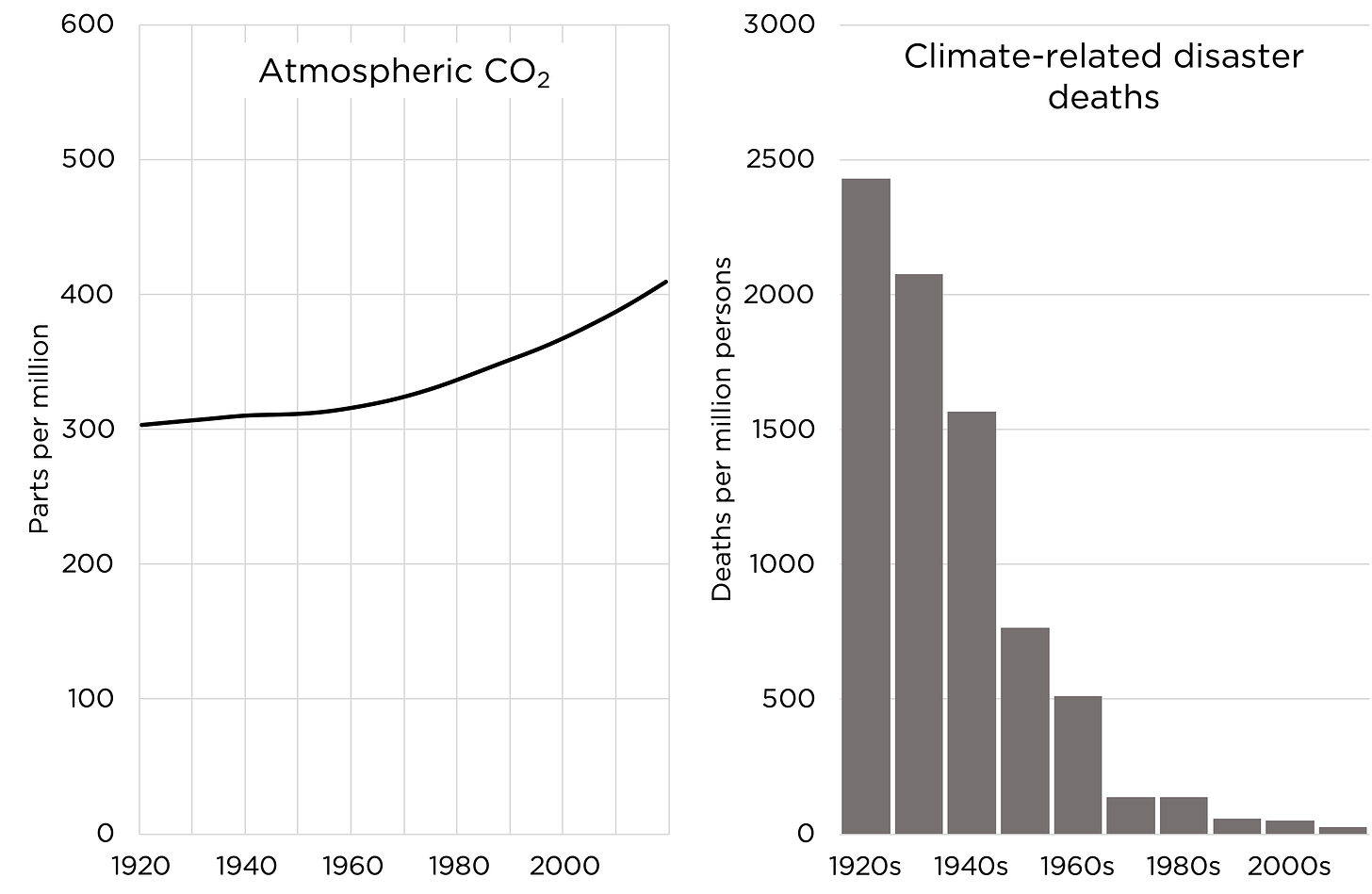

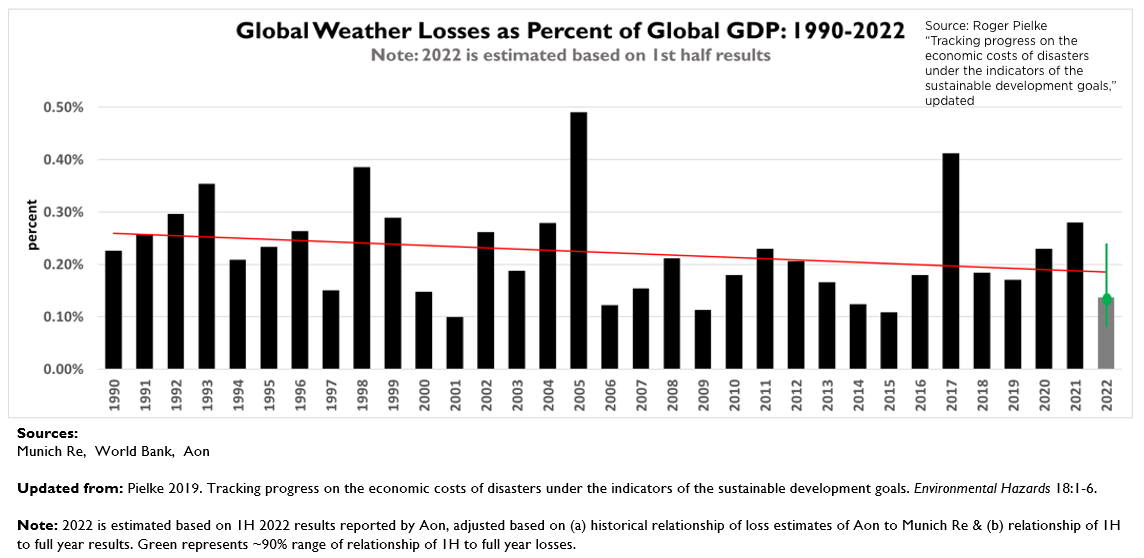

Multi-trillion-dollar claims about negative future climate impacts are absurd given that 1) climate-related disaster deaths are at record lows, and 2) climate-related damages as a percentage of GDP are flat.

These trends won't suddenly reverse at 1°C more warming.24

-

Ignoring the huge tax of anti-fossil-fuel policies

Most (bogus) “negative externality” calculations about fossil fuels’ negative climate impacts are dwarfed by the effective tax of the global anti-fossil fuel movement’s restrictions on fossil fuel

- investment

- production

- transport

- refining

-

The IMF uses a $60/ton “negative externality” for CO2, which means about 53¢/gallon of gasoline. If we were free to invest in, produce, transport, and refine fossil fuels without any of today’s irrational restrictions, gasoline prices would be lowered by much more than that.

-

Ignoring positive externalities

In the economic theory of externalities, one has to look at both negative and positive externalities. Yet attackers of fossil fuels ignore huge positive externalities, including more innovation, more greening, and fewer cold deaths.

-

The positive externality of innovation

One huge category of positive externality from fossil fuels is the amount of time that its uniquely cost-effective energy frees up from tasks like farming. Freed-up time underlies all innovation, from the Internet to Covid-19 vaccines.

-

Consider oil, which has long lacked any real alternative for powering airplanes.

Think about the time saved by airplanes, and how many innovations that has led to—in medicine, in food, etc. Yet these unpriced positive externalities of oil are ignored by anti-fossil-fuel “economists.”

-

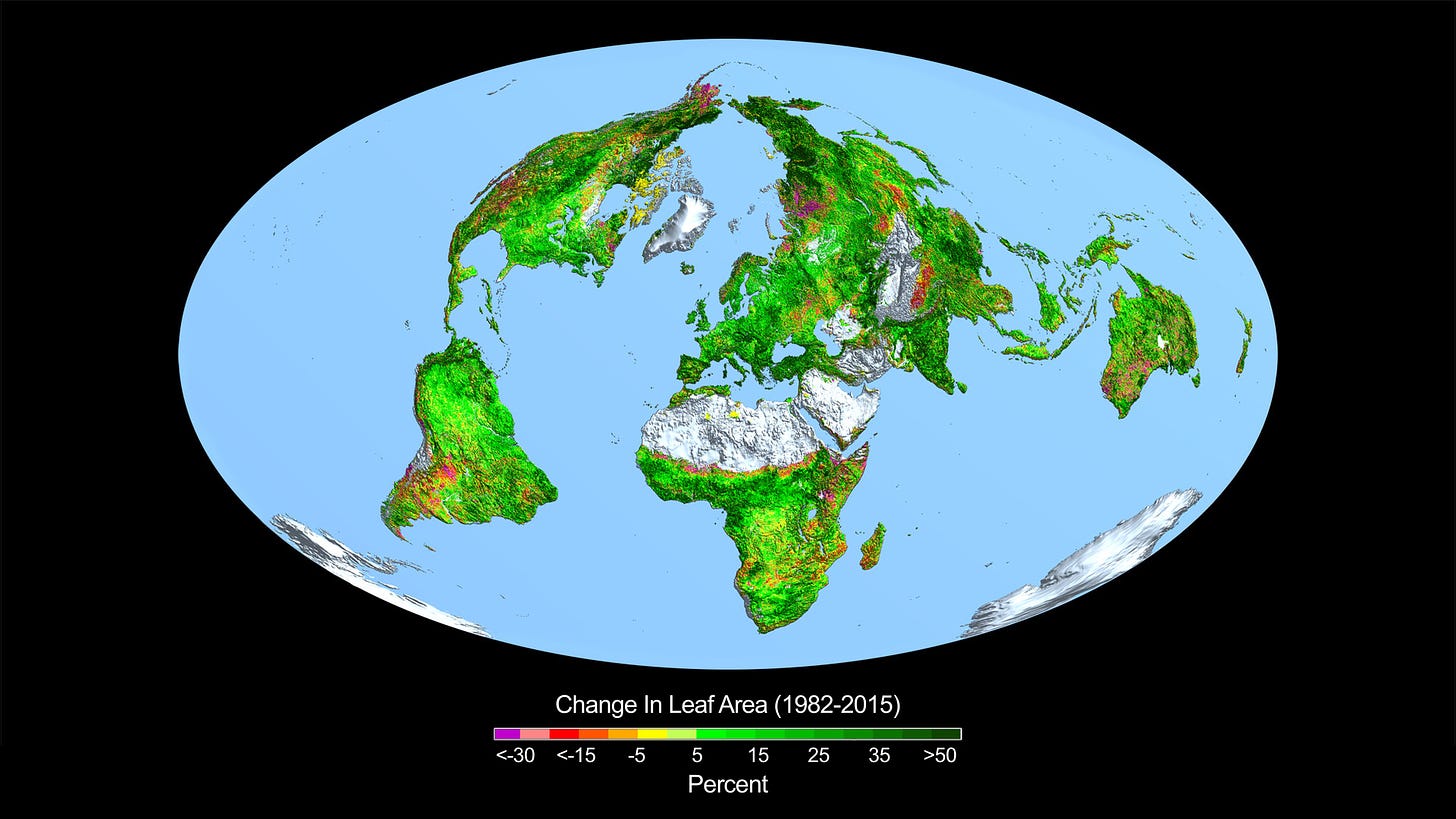

The positive externality of greening

CO2 in the atmosphere is a plant fertilizer. The planet has gained significantly in green vegetation for decades and a key driver of this is our addition of atmospheric CO2. This benefits both wilderness vegetation and crops.25

-

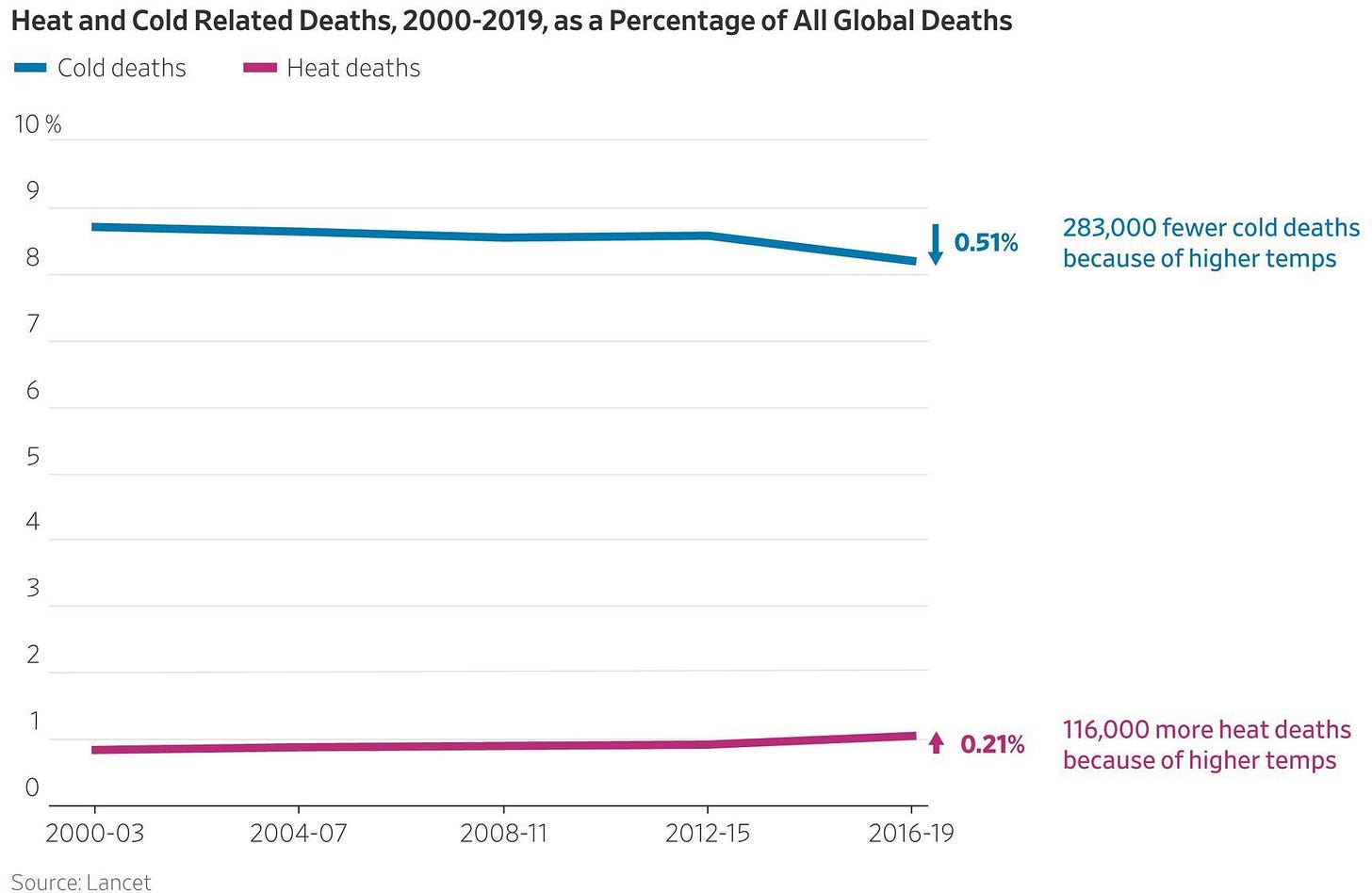

The positive externality of fewer cold-related deaths

Despite claims that Earth is too hot, far more people die from cold than from heat. Further, most global warming occurs in colder regions and at night. This means fossil fuel warming has major positive externalities—not just negative.26

-

The false claim of trillions in negative health externalities

Claims that air pollution from fossil fuels constitutes a multi-trillion-dollar negative externality commit the same fallacy as climate externality claims, including:

-

Ignoring positives

-

Hugely inflating negatives

-

-

The absurd 8.7M premature deaths claim

The most popular ammo for multi-trillion-dollar health externalities is a Harvard “study” claiming 8.7M people annually die early from fossil fuels. But these “deaths” occur mostly in the developing world, where fossil fuels have lengthened billions of lives.27

-

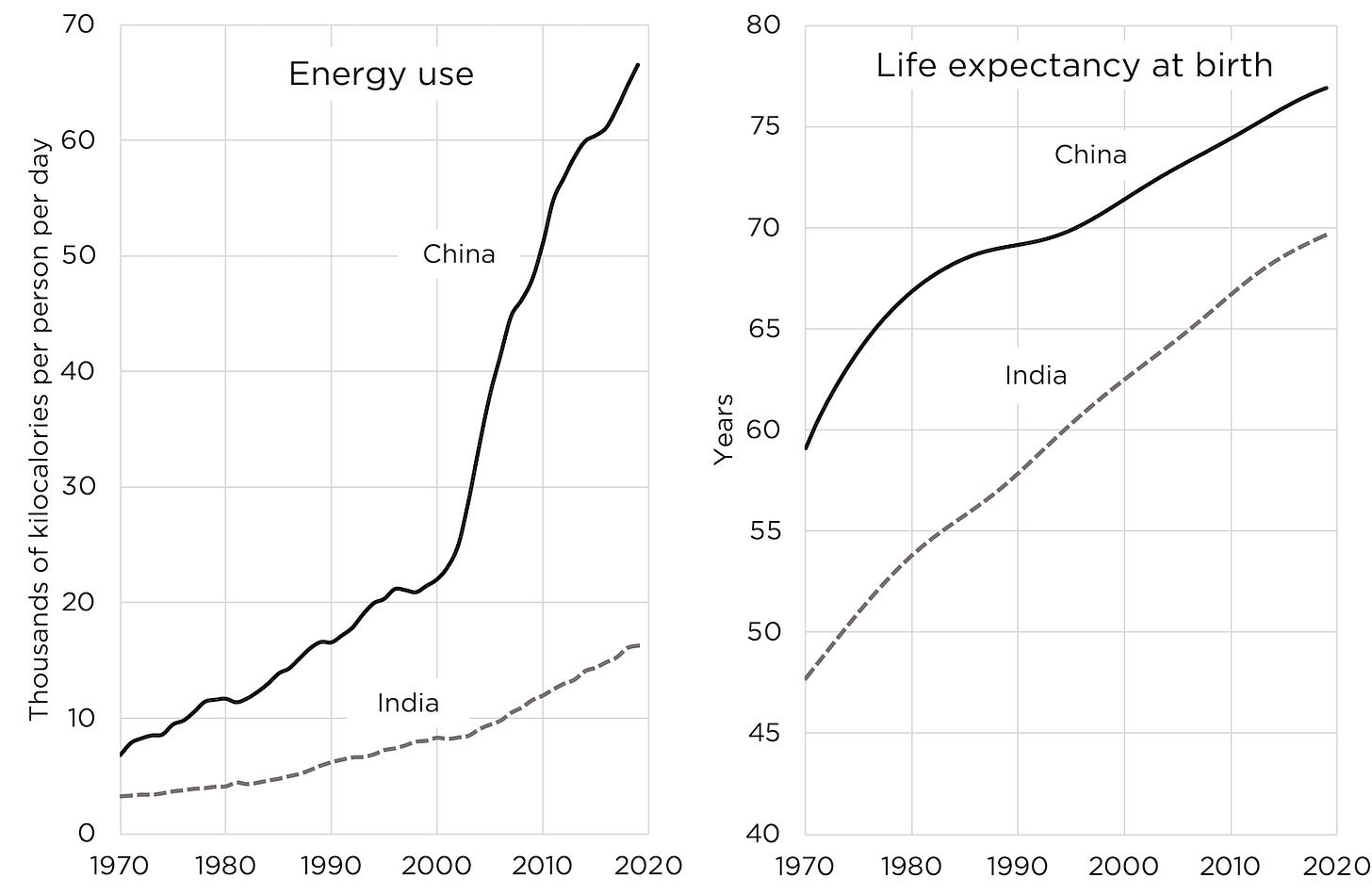

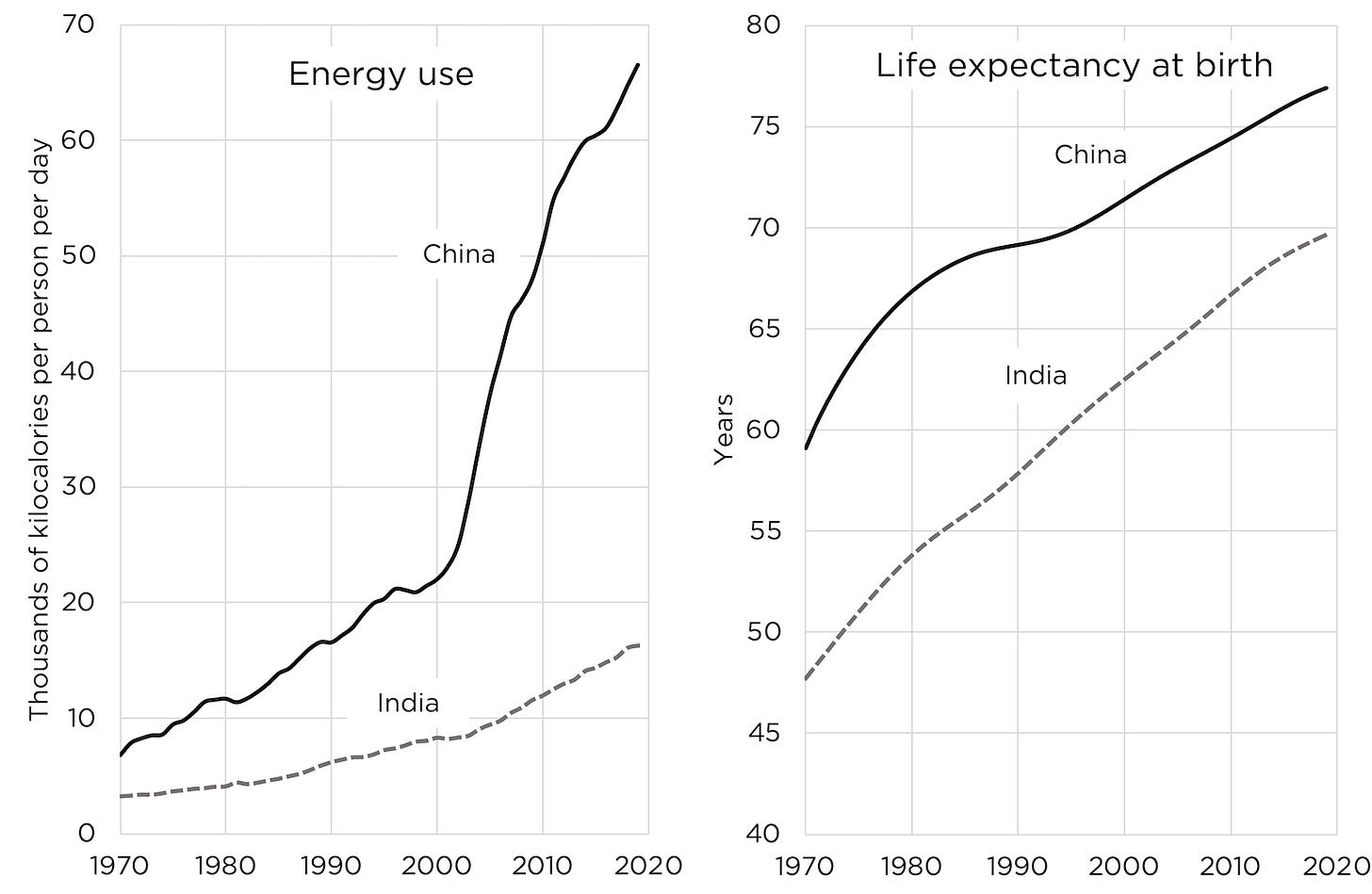

The Harvard study is based on highly speculative modeled pollution harm occurring mostly in developing countries, overwhelmingly China and India. Yet life expectancy in China and India has increased dramatically with energy use—overwhelmingly fossil fuel use.28

-

Since 1980, India's fossil fuel use has increased by 700% and China's has increased by 600%. Did this lead to many more premature deaths given “fossil fuels cause 1 in 5 deaths”? No, India's life expectancy increased by almost 16 years and China's increased by almost 10 29

-

The strong correlation between increasing fossil fuel use and increasing life expectancy is not coincidental—it is causal. Billions of people have brought themselves out of poverty by using uniquely cost-effective fossil fuels to power factories, farms, vehicles, and appliances.

-

The developing world overwhelmingly uses fossil fuels because that is by far the lowest-cost way for them to get reliable energy. Unreliable solar and wind can’t come close. That’s why China and India have hundreds of new coal plants under construction.30

-

Any study about fossil fuels’ side-effects should prominently mention their life-extending benefits. But many studies, funded by governments with anti-fossil-fuel agendas, systematically ignore fossil fuel positives and exaggerate fossil fuel negatives.

Note the overt political intent of the Harvard ‘study.’31

-

Fallacy 5: Conflating giveaways with subsidies

Claims that fossil fuels win due to subsidies often cite giveaways of fossil fuels by governments to their citizens.

But these giveaways don’t make fossil fuels cheap. They are based on fossil fuels because fossil fuels are already the cheapest option.

-

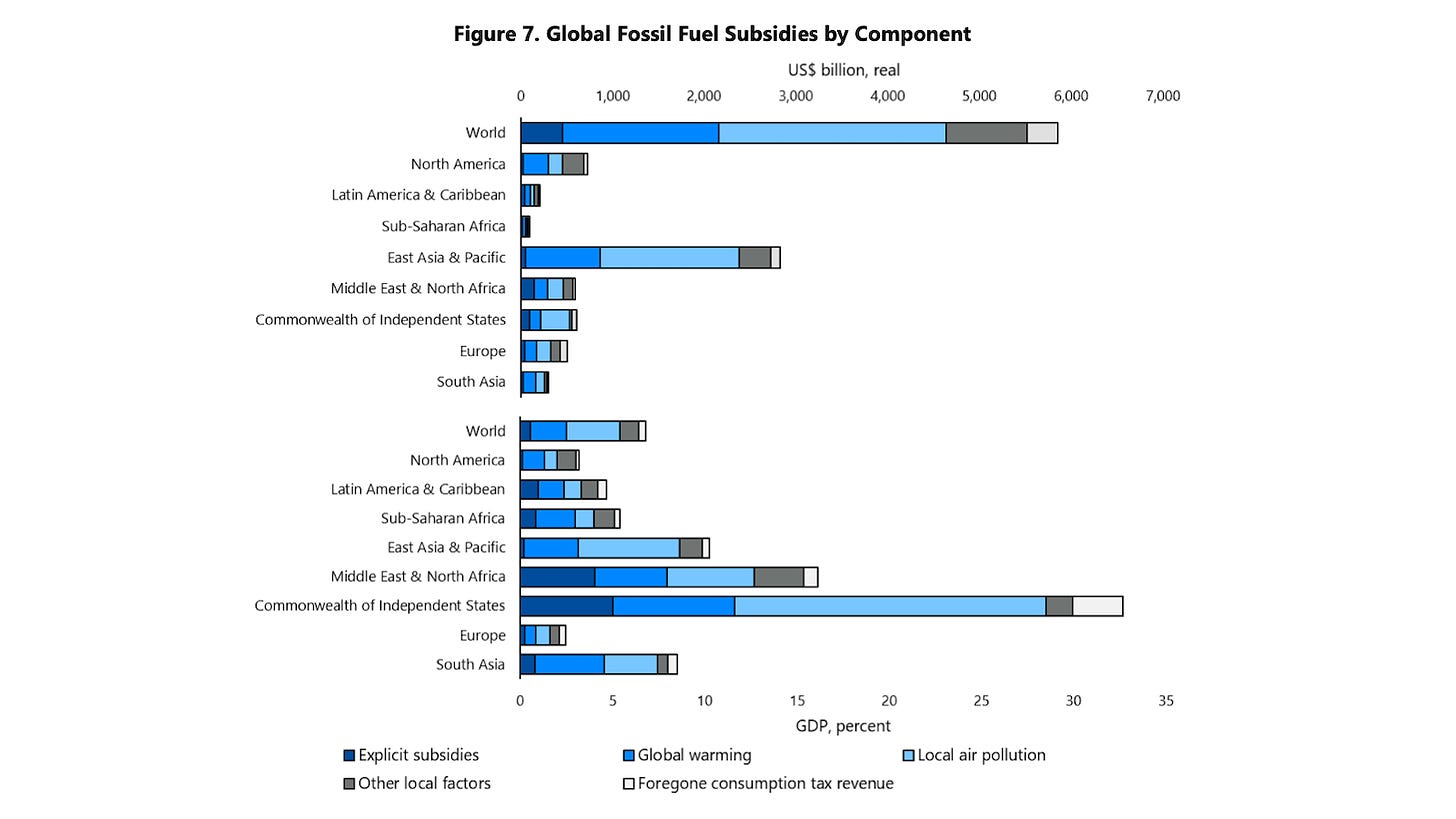

Dictatorships and governments of poor countries tend to support staple foods and energy financially to keep their governments stable.

This is visible in the global distribution of actual, “explicit” subsidies—vs. bogus “negative externalities” subsidy claims.32

-

If governments of poor countries had a cheaper alternative to fossil fuels, they would support that financially to pay off their citizens. These payments going to fossil fuels vs. unreliable solar and wind just demonstrates the lack of viable alternatives to fossil fuels.

-

The giveaways by unfree and poor countries to support their citizens are overwhelmingly not supporting fossil fuel industries, but supporting the standard of living of citizens. They are no more “fossil fuel” subsidies than food stamp programs are “agricultural subsidies.”

-

Fallacy 6: Conflating deductions with subsidies

Critics of “fossil fuel subsidies” point to “preferential” treatment of oil/gas drilling via “Intangible Drilling Cost” tax deductions. But IDCs are real upfront business expenses, like pharma R&D expenses, and should be deductible.

-

First things first: If anyone uses some small number of billions of dollars in “Intangible Drilling Costs” to claim that fossil fuels are unfairly subsidized, ask them if they recognize the at least hundreds of billions of dollars inflicted on companies by anti-fossil-fuel policies. If not, they aren’t serious.

-

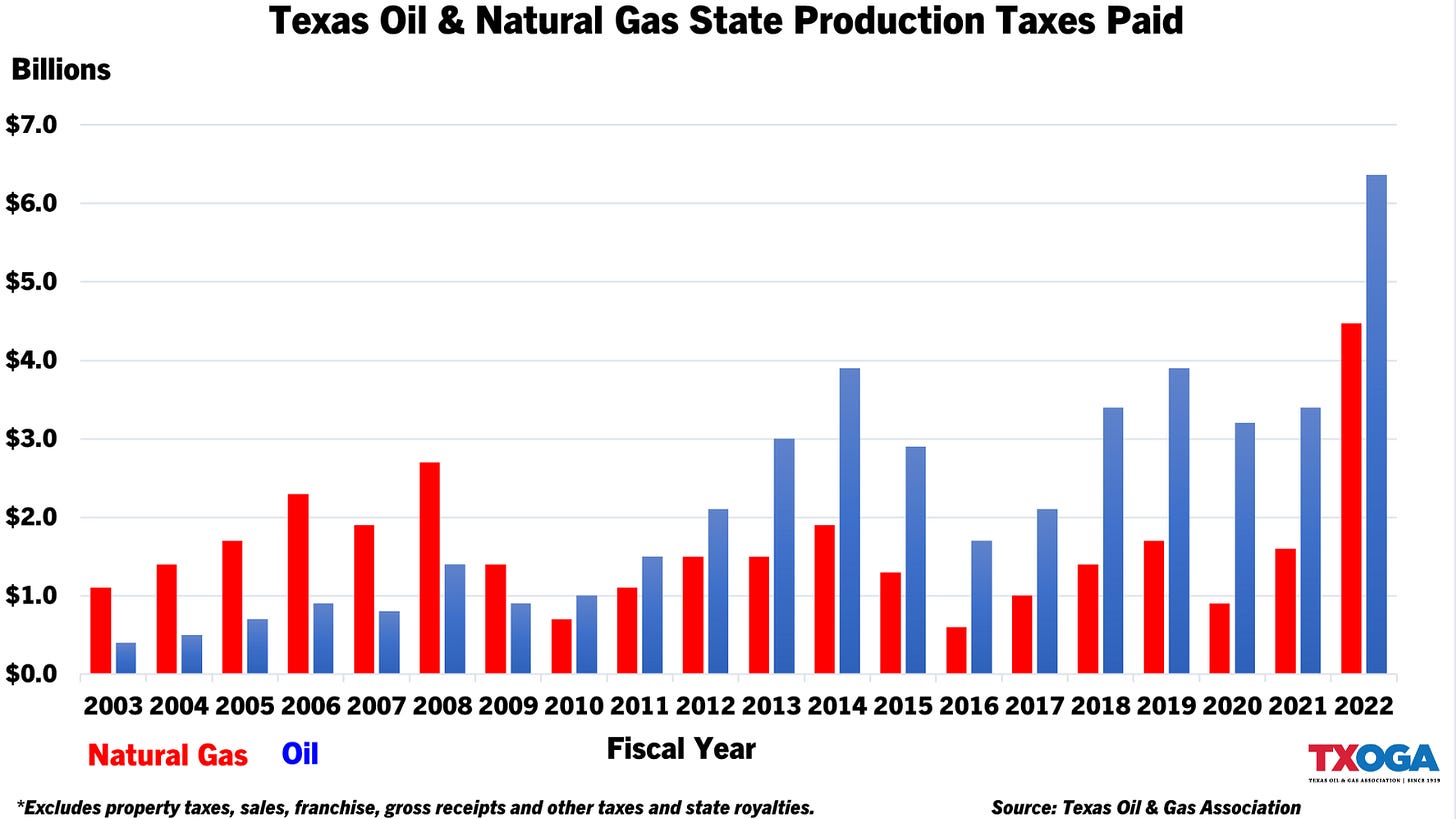

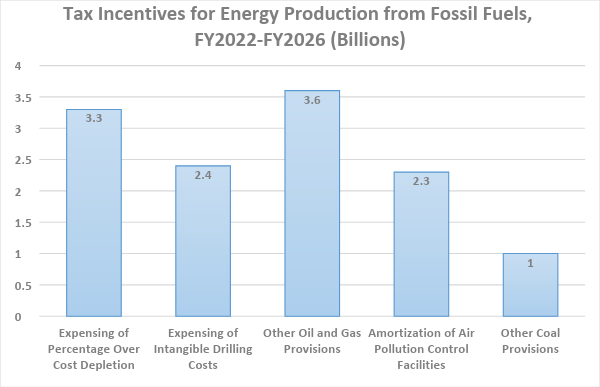

IDCs are small even in relation to just oil taxes, let alone other punishments.

These “special tax privileges” are estimated to amount to about $13 billion over 5 years, or $2.6 billion a year—nationally. Just in Texas, the oil & gas production tax probably generated more than $10 billion in 2022.33

-

Intangible drilling costs are actual business expenses related to the preparation of wells for production and drilling—but that lack salvageable value. These should be deductible.

-

Current rules allow oil companies to deduct all or a large percentage of IDCs immediately. Early deductibility, vs. spreading deductions over the lifetime of a well recognizes the distinctive nature of oil investment risk, in which failed exploration attempts need correction very early.

-

Attacking intangible drilling cost deductions as such is the equivalent of denying a pharma research company deduction of the expenses they had for drugs that never made it to market. But they still had the labs and researcher wages as business expenses for trying something out!

-

In contrast to a small accounting relief for oil & gas in a risky business, which is overburdened with taxes and regulations, solar and wind enjoy tax credits that the “Inflation Reduction Act” extended and expanded indefinitely while making them easier to transfer to unrelated businesses.

-

Summary: fossil fuel opponents use numerous fallacies to claim that fossil fuels are disproportionately subsidized, above all:

-

Ignoring the unique punishments the fossil fuel industry receives

-

Ignoring the unique preferences solar or wind receives

-

Hugely inflating “negative externalities”

-

-

Why do fossil fuel opponents engage in such bad thinking to claim that fossil fuels succeed due to subsidies?

Because if they recognized the truth—that fossil fuels succeed despite disproportionate punishment—they'd have to admit that anti-fossil-fuel policies deprive us of low-cost, reliable energy.

-

Anti-fossil-fuel politicians like Senator Whitehouse do not want to face the reality that they have helped cause a global energy crisis by disproportionately punishing fossil fuels, and that the new anti-fossil-fuel policies they want to implement will make things much worse. Their dishonesty is deadly.

-

All politicians who care about energy and human life should work to move us toward a policy of no subsidies—and, more broadly, no preferences or punishments for any particular type of energy.

Step 1 is to tell the truth: fossil fuels are disproportionately punished, not subsidized.

References

-

U.S. Senate Budget Committee - Chairman Whitehouse’s remarks, as prepared for delivery↩

-

IMF - Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies↩

-

SEC - SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors↩

-

Alex Epstein - It's time for Larry Fink to come clean about fossil fuels↩

-

CNBC - California bans the sale of new gas-powered cars by 2035

UtilityDive - New York begins implementation of 2035 ban on new gas-powered cars and trucks, following California lead↩

-

Breitbart - Joe Biden Promises Environmentalist: ‘Look into My Eyes; I Guarantee You, We Are Going to End Fossil Fuel’↩

-

Cody Campbell - Yes, Biden’s War On The Oil And Gas Industry Is Driving Shortages And High Prices↩

-

Alex Epstein - Talking Points on how Europe's fracking bans have contributed to its natural gas crisis↩

-

The Times (Ireland) - Liquefied natural gas terminals to be banned in law

Politico - French government blocks U.S. LNG deal as too dirty

Bloomberg - German Gas Terminal Faces Headwinds as Major Investor Steps Back

The Maritime Executive - Greenpeace Blocks Arrival of Gas Carrier at Spanish Gas Terminal↩

-

CNBC - Keystone pipeline officially canceled after Biden revokes key permit

Competitive Enterprise Institute - Lessons from the Demise of ANWR and Keystone XL↩

-

EQT - Nationwide Poll Shows Nearly 70% of All Voters Support Increasing Natural Gas Production↩

-

Financial Times - How China is winning the race for Africa’s lithium↩

-

U.S. EIA - U.S. refinery capacity decreased during 2021 for second consecutive year↩

-

Reuters - Biden White House blocks Virgin Islands refinery expansion permit over pollution concerns

Bloomberg - EPA Says It’s Under No ‘Pressure’ to Reopen St. Croix Refinery

The Virgin Islands Consortium - New Owners of Limetree Bay Plan to Increase Production to 450,000 Barrels Per Day, Want to Help St. Croix Reduce Energy Costs↩

-

CBS - Biden calls out oil refiners over "unprecedented" profits and urges them to produce more gasoline↩

-

Oil Price - Exxon Reconsidering Its Role In Europe Thanks To Windfall Taxes↩

-

AP - Biden increases oil royalty rate, scales back lease sales↩

-

U.S. EIA - How much tax do we pay on a gallon of gasoline and on a gallon of diesel fuel?↩

-

“Despite renewable energy receiving almost half the federal subsidies, EIA reported that fossil energy in the form of coal, oil, natural gas and natural gas plant liquids made up 78.1 percent of primary energy production in FY 2016.

…

In FY 2016, certain tax provisions related to oil and natural gas yielded positive revenue flow for the government, resulting in a negative net subsidy of $773 million for oil and natural gas, based on estimates from the U.S. Department of Treasury.”

Institute for Energy Research - EIA Report: Renewable Energy Still Dominates Energy SubsidiesTerry Dinan - U.S. House of Representatives testimony, 2017 (p. 4)↩

-

Texas Public Policy foundation - The Siren Song that Never Ends: Federal Energy Subsidies and Support from 2010 to 2019↩

-

IMF - Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies↩

-

U.S. Senate Budget Committee - Chairman Whitehouse’s remarks, as prepared for delivery↩

-

UC San Diego - The Keeling Curve

For every million people on earth, annual deaths from climate-related causes (extreme temperature, drought, flood, storms, wildfires) declined 98%--from an average of 247 per year during the 1920s to 2.5 in per year during the 2010s.

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates for the 1920s from the Maddison Database 2010, the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen. For years not shown, population is assumed to have grown at a steady rate.

Population estimates for the 2010s come from World Bank Data.

Roger Pielke Jr. - Weather and Climate Disaster Losses So Far in 2022, Still Not Getting Worse

Roger Pielke Jr. - Tracking progress on the economic costs of disasters under the indicators of the sustainable development goals↩

-

NASA - Carbon Dioxide Fertilization Greening Earth, Study Finds

Regional trends vary, but overall the world's leaf area increased by 5.4 million square kilometers, or an amazon rainforest worth of greening, between 2000 and 2017 alone with over 1/3 of vegetated land showing an increase while only 5% showed a loss of green vegetation.

“Long-term satellite records reveal a significant global greening of vegetated areas since the 1980s, which recent data suggest has continued past 2010. … Global vegetation models suggest that CO2 fertilization is the main driver of global vegetation greening.”

Piao, S., Wang, X., Park, T. et al. Characteristics, drivers and feedbacks of global greening. Nat Rev Earth Environ 1, 14–27 (2020)↩ -

Bjorn Lomborg - Climate Change Saves More Lives Than You’d Think

NOAA - Climate change rule of thumb: cold "things" warming faster than warm things

-

Vohra et al. (2021) - Global mortality from outdoor fine particle pollution generated by fossil fuel combustion: Results from GEOS-Chem↩

-

Vohra et al. (2021) - Global mortality from outdoor fine particle pollution generated by fossil fuel combustion: Results from GEOS-Chem↩

-

IMF - Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies↩

-

Institute for Energy Research - Biden FY2024 Budget Eliminates Tax Deductions for the Oil and Gas Industry↩