Originally Published: February 27, 2025

Congress has the opportunity to fulfill Donald Trump’s pledge to “terminate the Green New Scam” aka Inflation Reduction Act subsidies. This will

-

Save us trillions

-

Lower cost of living

-

Create productive jobs

-

Reduce corruption

Tell your Representatives to end all IRA subsidies!

-

The IRA (aka “Green New Scam”) has 8 key subsidies.

Each subsidy 1) increases the debt, 2) increases cost of living, 3) prevents productive business and jobs from being created, and 4) increases corruption.

But each also has lobbyists falsely claiming they’re good for America.1

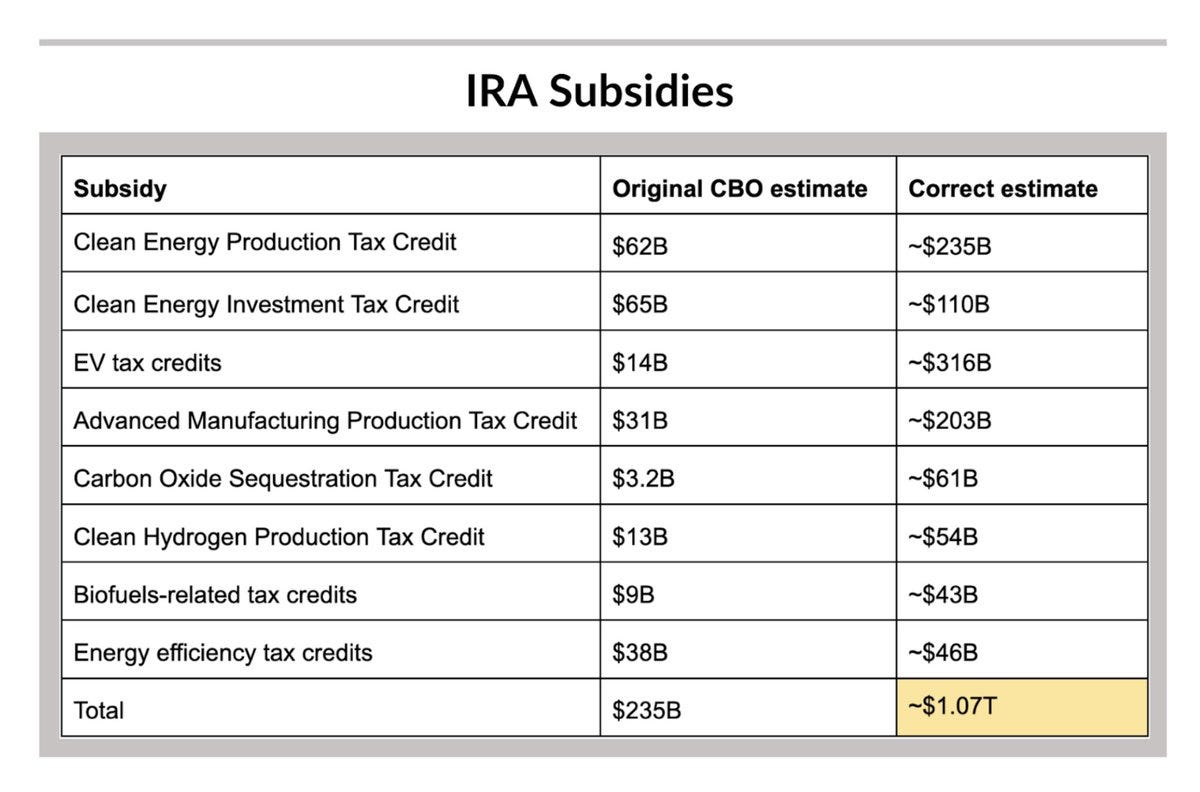

IRA subsidies increase the debt by trillions

-

Credible estimates show the IRA costing the budget over $1 trillion over the next decades and trillions more after that.

DOGE, take note: these trillions can be cut and it won’t cost the American people but hugely benefit them!2

IRA subsidies increase cost of living

-

A higher federal debt means the need for more borrowing by the government, which drives up interest rates for everyone—meaning more expensive homes and cars.

Terminating the IRA will make homes and cars cheaper.3

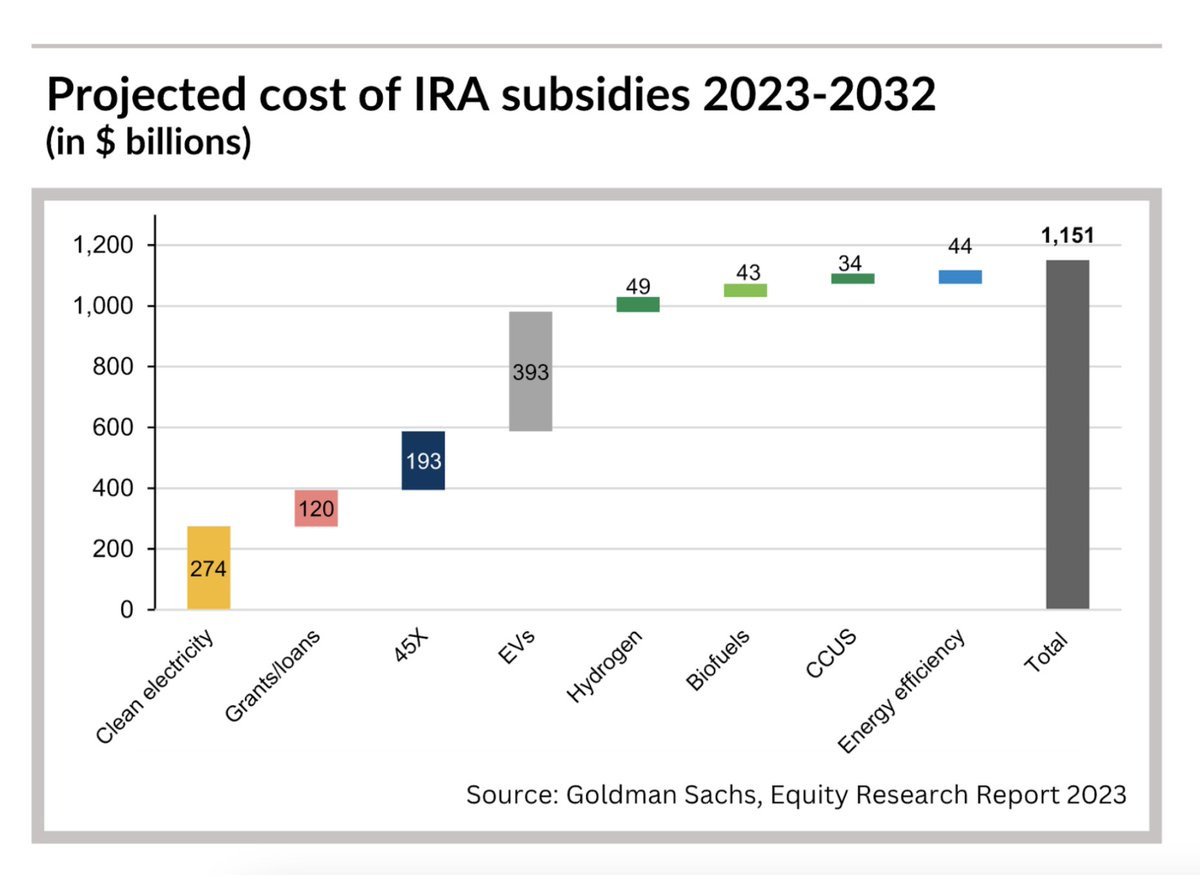

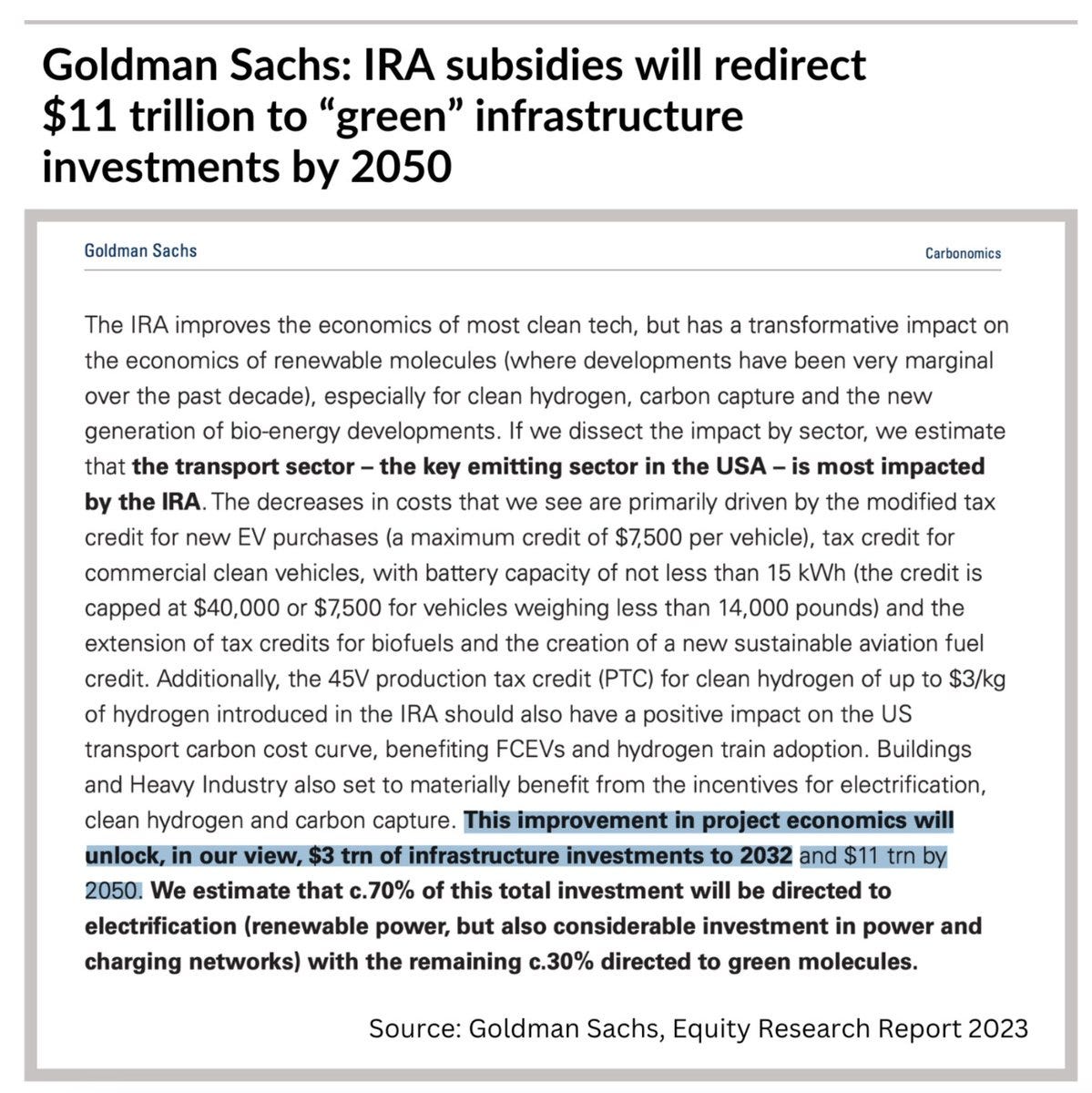

IRA prevents productive businesses and jobs from being created

-

The IRA will lead to the misallocation of $3 trillion into uncompetitive businesses that would otherwise be invested in truly productive businesses.

Terminating the IRA will create new, lasting businesses and jobs.4

IRA subsidies create corruption

-

By subsidizing all forms of energy, including oil and gas, like never before, the IRA has switched much of industry’s focus from creating cheap, reliable energy to lobbying for more subsidies.

Terminating the IRA will Make Energy Great Again.5

IRA subsidies are destroying our grid

-

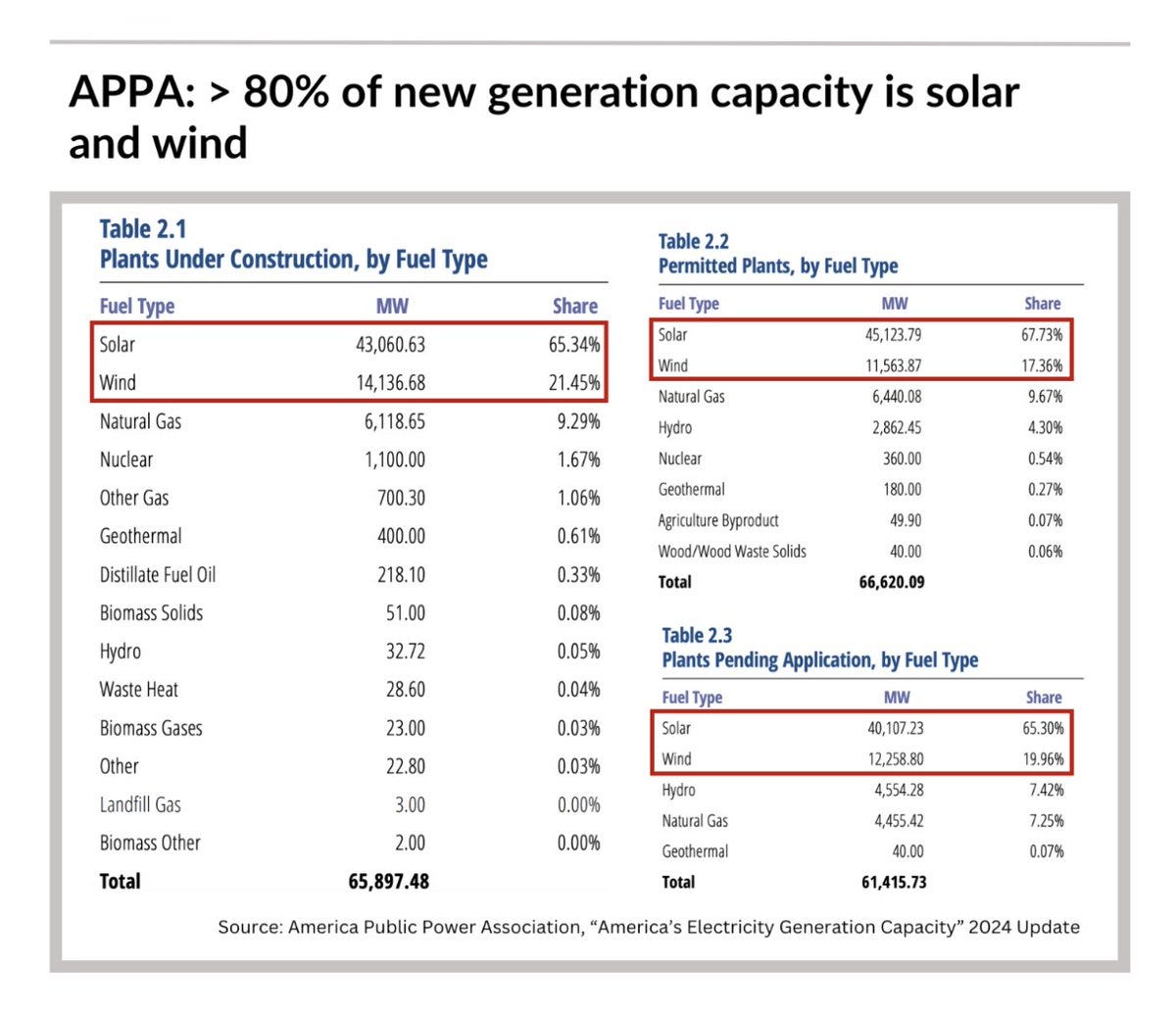

While all IRA subsidies need to go, the worst are “Clean Electricity,” which pay electricity markets to defund reliable gas/coal plants and fund intermittent solar/wind.

Terminating the IRA will make electricity cheaper and more reliable.6

-

Myth: IRA subsidies benefit many states and districts, especially Republican ones, by subsidizing businesses and jobs.

Truth: IRA is creating a small number of unsustainable jobs—while harming every American with inflation, less economic opportunity, and a declining grid!7

-

Lobbyists for subsidy-seeking business are pressuring politicians, especially Republican ones, by claiming that terminating the IRA will cause catastrophic loss of investment in businesses and jobs.

But IRA hasn’t created new investment, it’s diverted investment to uncompetitive businesses and jobs.8

-

Based on the data cited by DOE, in 2023, the IRA resulted in the creation of up to 142,000 jobs.

For comparison, in 2023, according to the Bureau of Labor Statistics, the US economy as a whole created 2.6 million jobs.9

-

Most or all of the IRA’s meager 142,000 jobs created in 2023 would have likely been created in other, more productive businesses. In any case, IRA-subsidized jobs cost us a fortune.

For example, we’re paying $2-7 million each for EV jobs that pay less than the national average!10

-

Myth: Removing IRA subsidies would create harmful instability by making financial support for certain projects unpredictable.

Truth: We want instability for subsidized projects, so that companies invest in real value creation and avoid subsidy-seeking.

-

Lobbyists who want to keep their IRA subsidies at the expense of the country like to say we should “use a scalpel” to cut other subsidies but not theirs.

But a good surgeon uses a scalpel to cut out the whole cancer—and that’s what we need to do with the IRA.

References

-

Crux Climate - An ultimate guide to transferable tax credits

Credit Suisse - US Inflation Reduction Act – A tipping point in climate action (see page 14)

Cato Institute - The Budgetary Cost of the Inflation Reduction Act’s Energy Subsidies (see Figure 2)

U.S. Treasury - Tax Expenditures, Fiscal Year 2026

Stillwater Associates - How does the cost of Hydrogen stack up against gasoline?

-

Cato Institute - The Budgetary Cost of the Inflation Reduction Act’s Energy Subsidies↩

-

American Enterprise Institute - An Expanded and Updated Analysis of the Federal Debt’s Effect on Interest Rates↩

-

SEN - Major Oil Firms Lobby to Protect IRA’s Carbon Capture Incentives

PBS - Biden’s Inflation Reduction Act aimed to boost renewable energy. Subsidies could help one company reap billions↩

-

American Public Power Association - America’s Electricity Generation Capacity, 2024 Update↩

-

Good Jobs First - Power Outrage: Will Heavily Subsidized Battery Factories Generate Substandard Jobs?↩

-

Utility Drive - 21 House Republicans oppose cutting clean energy credits to pay for tax cuts↩

-

DOE - DOE Report Shows Clean Energy Jobs Grew at More Than Twice the Rate of Overall U.S. Employment↩

-

Good Jobs First - Power Outrage: Will Heavily Subsidized Battery Factories Generate Substandard Jobs?↩