Originally published: Mar 16, 2024

Congress won't support Biden's anti-fossil-fuel agenda.

So he's circumventing the legislative process by having the SEC coerce companies into spouting anti-fossil-fuel propaganda and committing to anti-fossil-fuel plans in the name of “climate disclosure.”

-

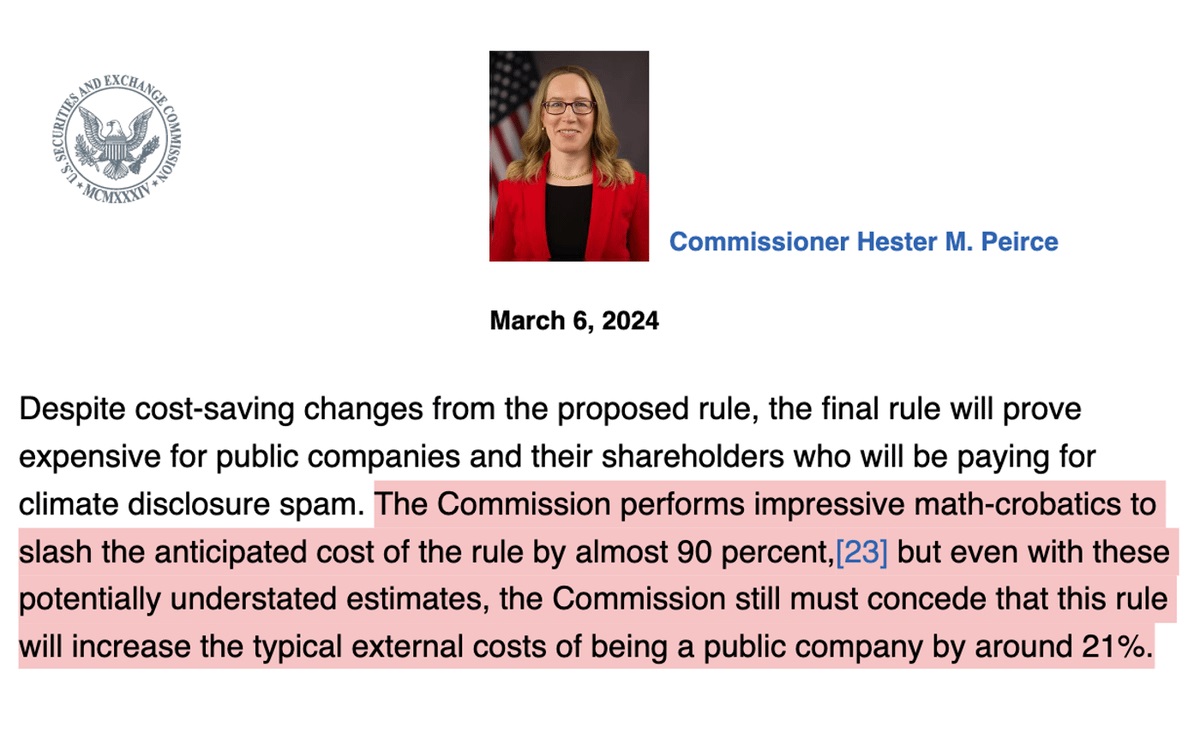

The Securities and Exchange Commission’s (SEC) new rules have gotten many valid criticisms. E.g., they'll force companies to do endless, costly paperwork, which discourages private companies from going public and thus contradicts the SEC's goal of increasing the range of companies we can invest in.1

-

Sadly, most critics of the SEC’s rules are missing the biggest, most dangerous problem: they're not actually “climate disclosure rules”—those already existed—they are anti-fossil-fuel propagandizing and planning rules that violate freedom of speech and endanger our economy.

How the SEC's required “disclosure” of “climate-related risks” coerces companies into propagandizing for climate catastrophe:

-

The purpose of “disclosure,” and the reason for requiring it, is that there are certain facts a company knows about, including its current plans for the future, that are material to investors making an assessment of its future prospects. E.g., if a CEO has stage 4 cancer.

-

The SEC already required real climate-related disclosures. Companies had to disclose facts about their company and plans that various future climate scenarios might impact. E.g., real estate developers were already required to disclose existing and planned beachfront properties.2

-

The “climate-related risks” the SEC now requires companies to disclose are not facts the company has distinct access to but instead opinions about climate science and climate economics—subjects most companies have little-to-no distinct knowledge of.

-

What opinions are companies with no distinct knowledge of climate science/economics supposed to disclose to the government about these subjects? The opinions of the government asking for them, of course—which in the case of this administration means: climate catastrophism.

-

SEC Chairman Gary Gensler swears that the SEC isn't looking for any particular opinion: “We’re agnostic with regard to climate risk.” But him singling out “climate risk” as a subject of disclosure is itself based on the opinion that climate risk is extremely and uniquely high.3

-

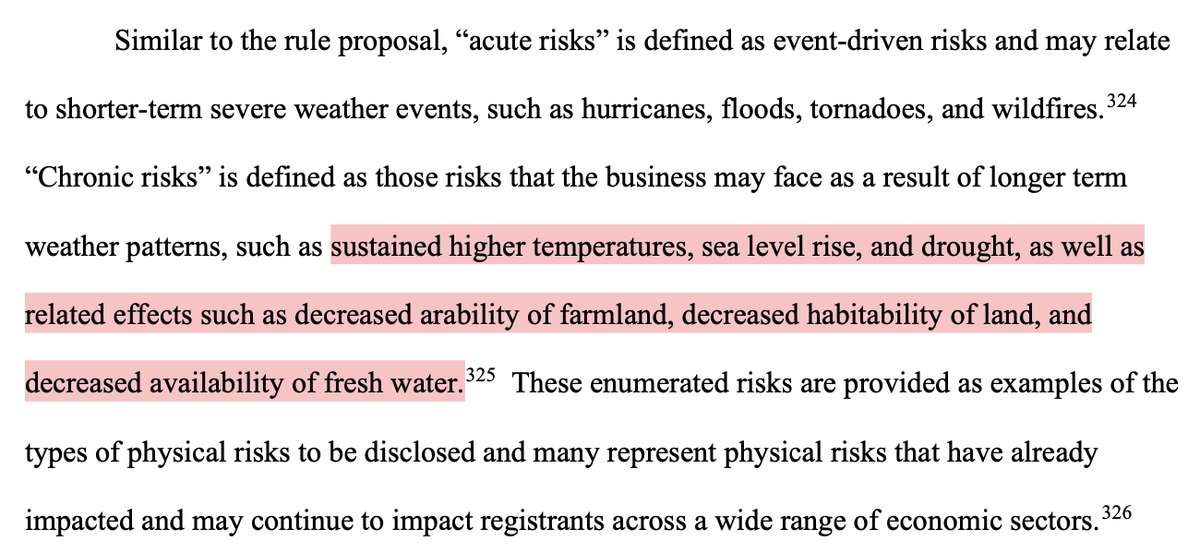

Telegraphing the catastrophist opinions they are looking for, the Biden SEC's examples of “climate-related risks” involve rapid, exclusively-negative climate changes—something many reasonable people, including many climate scientists and economists, disagree with.4

-

Businesses deciding what opinions on climate science and climate economics to “disclose” know that the SEC today is part of a catastrophist Biden administration that will be inclined to approve of catastrophist opinions and disapprove of non-catastrophist ones.

-

If a firm's stock falls and it is viewed as not having properly disclosed related risks, it is vulnerable to shareholder lawsuits and SEC punishment.

When climate opinions are required as part of disclosure, a non-catastrophist company may be just one stock drop from peril.

-

Consider a real estate firm that's skeptical of 3 ft per 100 years sea level rise projections (the current rate is ~1 ft), and even more skeptical that adaptation will be extremely costly.

If the firm's stock falls, catastrophists will surely blame its heretical climate opinions.5

-

Catastrophists blame everything on “climate change.” In 2020, when shale oil stocks obviously collapsed due to Covid and overinvestment, catastrophists still claimed it was that “climate change” had made oil “unsustainable.” (Oil stocks soon sustained fantastic gains.)6

-

Given that we have a catastrophist administration that blames everything on climate change, a real estate company or any other company would be inviting destruction by “disclosing” non-catastrophist opinions that will make it an easy target whenever its stock drops significantly.

-

If companies “disclose” government-favored catastrophist opinions, they can feel relatively safe—even if those opinions turn out to be false and lead to destructive actions.

Does anyone think Biden's SEC will punish a catastrophizing solar company if its predictions come false?

-

When a catastrophist administration forces companies to disclose climate opinions, voicing catastrophist opinions is safe and voicing non-catastrophist opinions is dangerous. Thus, “climate disclosure rules” are actually anti-fossil-fuel propagandizing rules.

-

“Climate disclosure” rules that coerce companies to propagandize certain climate opinions are a complete violation of the First Amendment, and should be thrown out by judges on that basis alone. (And should have never been considered by the Administration on that basis alone.)

-

“Climate disclosure” rules that coerce companies to propagandize certain climate opinions are also a major threat to our economy, because they mislead the public into thinking that climate catastrophism and anti-fossil-fuel policies are more supported by industry than they are.

-

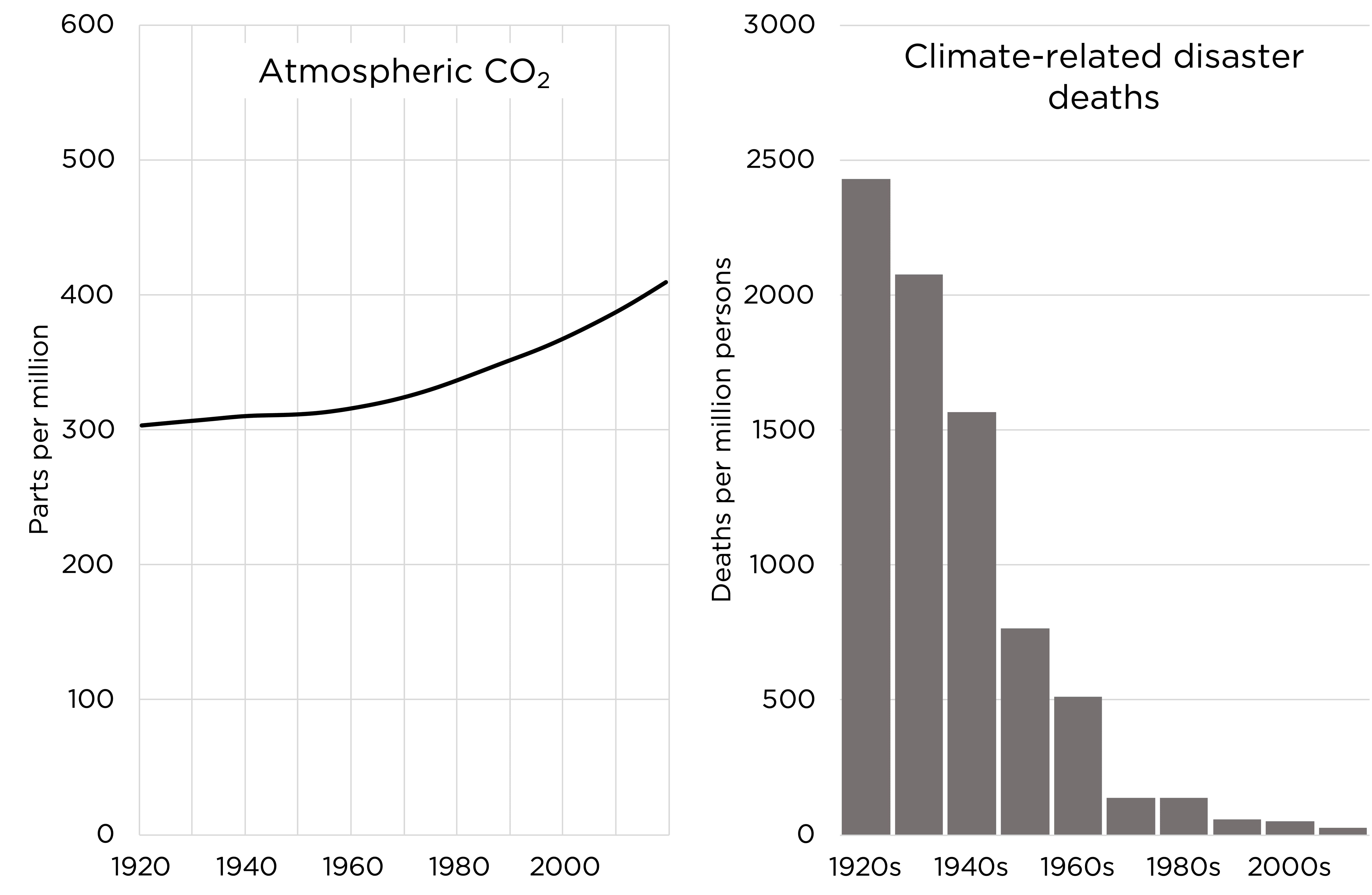

Many executives believe that we can master any climate challenges we face from rising CO2, in large part by using machines powered by fossil fuels—just as we've done to date, with climate disaster deaths decreasing 98% over the last century.

Such opinions must not be suppressed.7

-

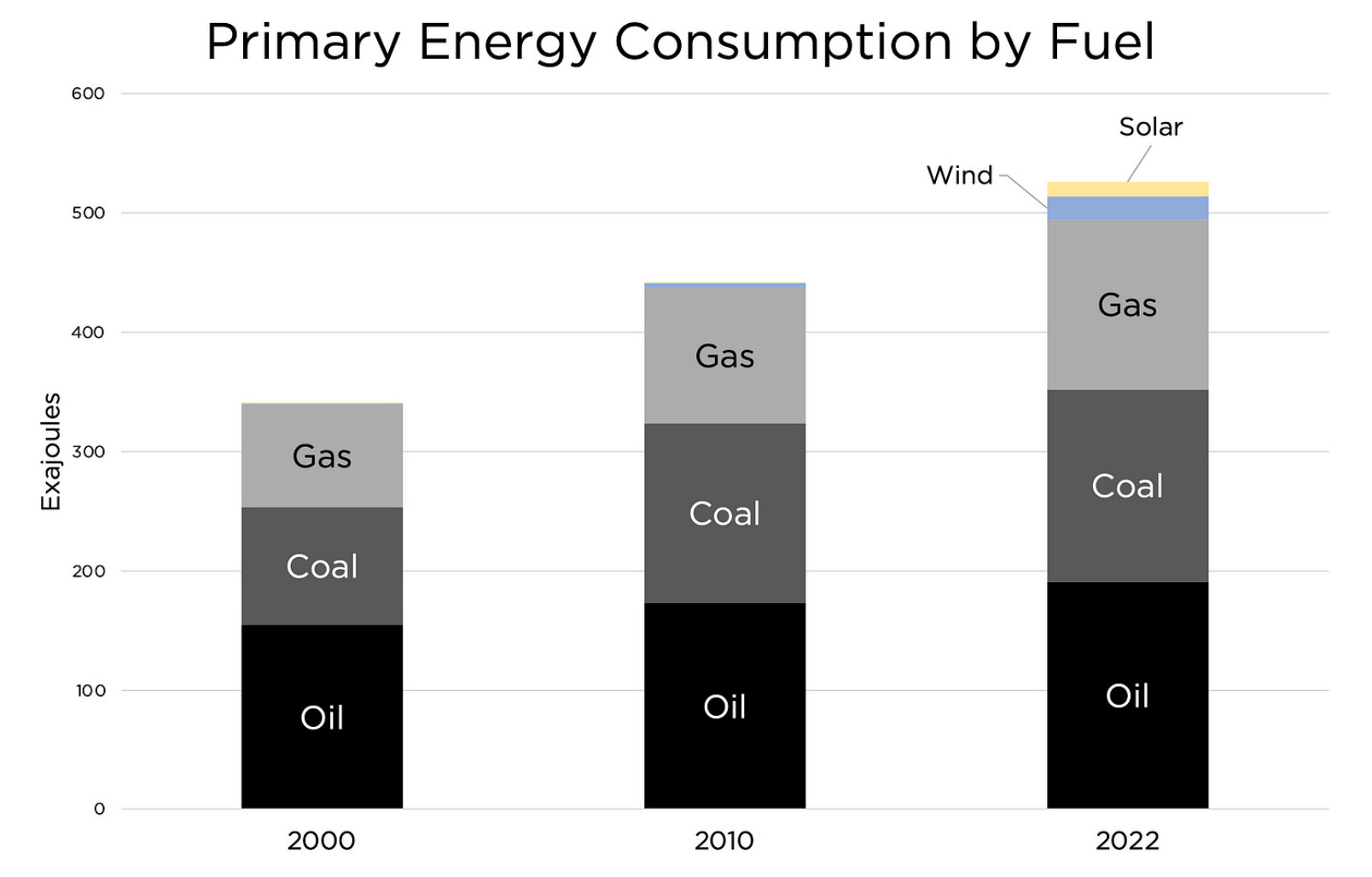

Many executives believe that energy availability matters a lot more than climate changes, and that fossil fuels will for decades remain a uniquely cost-effective and scalable way to power America and the world (much of which is energy-poor).

Such opinions must not be suppressed.8

How the SEC's required “disclosure” of “transition plans” coerces companies into committing to anti-fossil-fuel plans:

-

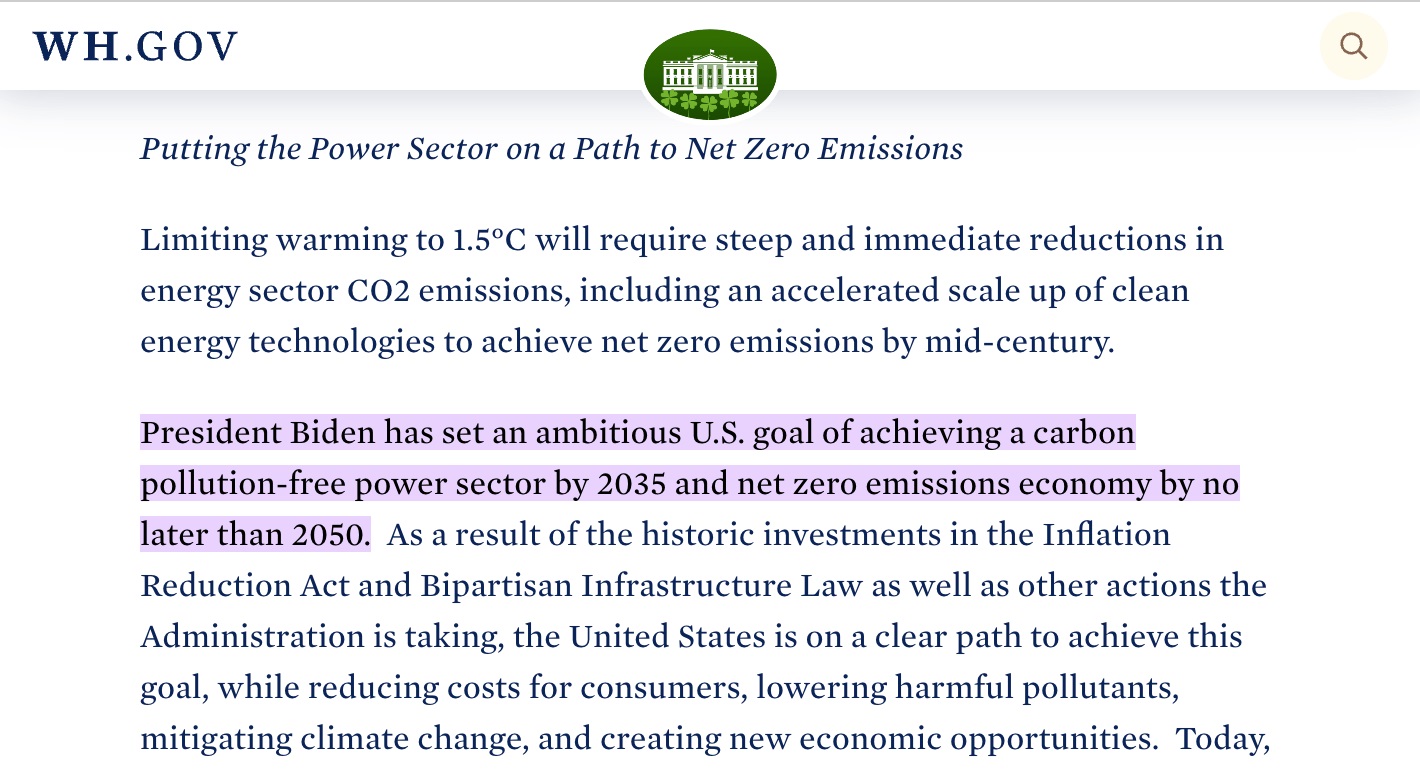

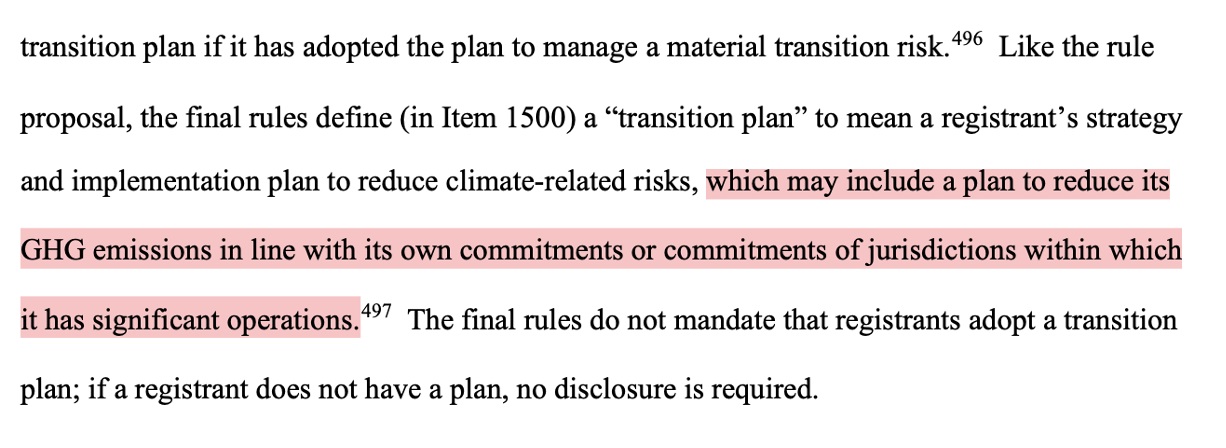

Not only do the SEC's “climate disclosure rules” coerce companies into propagandizing catastrophist climate opinions, they also coerce companies into actually making “transition” plans based on climate catastrophism and the Administration's favored “net zero” policies.

-

The SEC tries to make its rules around “transition plans” look non-coercive by saying they “do not mandate that registrants adopt a transition plan.” But if companies express catastrophist views—which the SEC coerces them into doing—it's illogical not to have a “transition plan.”9

-

The very idea of a “transition plan” is itself a catastrophist idea—that rising CO2 will cause such catastrophic climate and economic changes that we must all undergo a rapid “energy transition” or else be destroyed. (Even though empirically we're safer from climate than ever.)

-

Given that companies are being compelled by a catastrophist administration to present a “transition plan,” what kind of plan will they feel compelled to present?

Obviously one the Administration likes, which everyone knows means a “net zero” plan to rapidly abandon fossil fuels.

-

Even if there were extremely disruptive climate changes ahead—contradicting 100 years of increasing climate safety—the centerpiece of any “transition plan” should be adapting to those changes, which will often mean using more energy, which will often require more fossil fuels.

-

While a logical climate “transition plan” for many companies would mean increasing fossil fuel use and therefore greenhouse gas emissions to adapt, the Biden SEC makes it clear that they're not looking for that kind of plan. Instead, their sole suggestion is: commit to reducing emissions.10

-

Just as "disclosing" a Biden-contradicting view of “climate risk” risks lawsuits and prosecution, so does "disclosing" a Biden-contradicting “transition plan.” So companies will make “net zero” plans they don't believe in. Which means government is dictating business plans.

-

Government dictating business plans in an anti-fossil-fuel direction under the fraudulent pretense of “climate disclosure,” is both deeply anti-American and deeply dangerous.

Because the energy industry powers every other industry, bad energy plans harm all of us.

-

We've already seen from the ESG movement how pushing companies against fossil fuels harms everyone. From 2011-2021, ESG contributed to oil and gas exploration investments declining 50%. Less investment = less supply = higher energy prices = higher prices for everything.11

The ESG movement is anti-energy, anti-development, and anti-America -

The goal of much of the ESG movement was to prod investors and corporations into adopting anti-fossil-fuel plans that voters were unwilling to vote for. Now the SEC is using the direct force of government to do the same thing. Congress, the courts, and citizens must fight back.

-

Summary: The SEC is coercing companies into spouting anti-fossil-fuel propaganda and committing to anti-fossil-fuel plans in the name of “climate disclosure.” This is a violation of free speech and a threat to our economy. We must do everything we can to reverse this abomination.

References

-

SEC - SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors↩

-

Hester M. Peirce - We are Not the Securities and Environment Commission - At Least Not Yet↩

-

Politico - ‘Not a climate activist’: Gensler clashes with allies over new rule↩

-

SEC - The Enhancement and Standardization of Climate-Related Disclosures for Investors↩

-

University of Colorado, Sea Level Research Group - Global Mean Sea Level (Seasonal Signals Removed)↩

-

Greenpeace/Rex Weyler - The decline of oil has already begun

The Guardian - Will the coronavirus kill the oil industry and help save the climate?↩

-

UC San Diego - The Keeling Curve

For every million people on earth, annual deaths from climate-related causes (extreme temperature, drought, flood, storms, wildfires) declined 98%--from an average of 247 per year during the 1920s to 2.5 per year during the 2010s.

Data on disaster deaths come from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be (D. Guha-Sapir).

Population estimates for the 1920s from the Maddison Database 2010, the Groningen Growth and Development Centre, Faculty of Economics and Business at University of Groningen. For years not shown, population is assumed to have grown at a steady rate.

Population estimates for the 2010s come from World Bank Data. Our World in Data - Annual CO₂ emissions by world region↩

-

SEC - The Enhancement and Standardization of Climate-Related Disclosures for Investors↩

-

SEC - The Enhancement and Standardization of Climate-Related Disclosures for Investors↩

-

Alex Epstein - It's time for Larry Fink to come clean about fossil fuels

Alex Epstein - The ESG movement is anti-energy, anti-development, and anti-America

Financial Times - Embrace high fossil fuel prices because they are here to stay

Michael Shellenberger - How Climate Activists Caused the Global Energy Crisis↩