Originally published: Mar 23, 2024

How to solve America's critical minerals problem:

1) liberate domestic industry to mine and process them cost-effectively

2) encourage friendly trading partners to do the same

3) stop artificially driving up demand before supply chains are ready.

-

America’s economy and its national security depend on the secure availability of numerous “critical minerals”—such as lithium, copper, cobalt, and various “rare earth” elements—that, due to their unique chemical properties, are essential for many of today’s leading technologies.

-

Take cobalt, an important ingredient in the high-tech alloys used in many batteries, jet engines, and permanent magnets. Without a secure supply of cobalt, production of significant portions of high-tech industry and high-performance military equipment are jeopardized.1

-

To have ample, secure critical minerals, we must:

- liberate domestic industry to mine and process them cost-effectively

- encourage friendly trading partners to do the same

- not artificially drive up demand before supply chains are ready

We are doing the exact opposite.

Our failure to liberate critical mineral mining and processing

-

Critical mineral production has 2 key phases: mining (extracting minerals from the earth) and processing (transforming them into useful form).

Our anti-development policies make both phases costly or impossible.

-

Consider domestic mining for critical minerals, which can only be done cost-effectively if producers can move quickly.

It used to be fast to build a mine in America. But no longer.

Today, it takes more than a decade to open a new mine—if it’s allowed at all.2

-

Consider the fate of Twin Metals Minnesota’s mining project, which would have been a leading US source of copper and nickel. This project was delayed for almost a decade, then stopped completely in 2022 after our Department of the Interior banned mining in the area.3

-

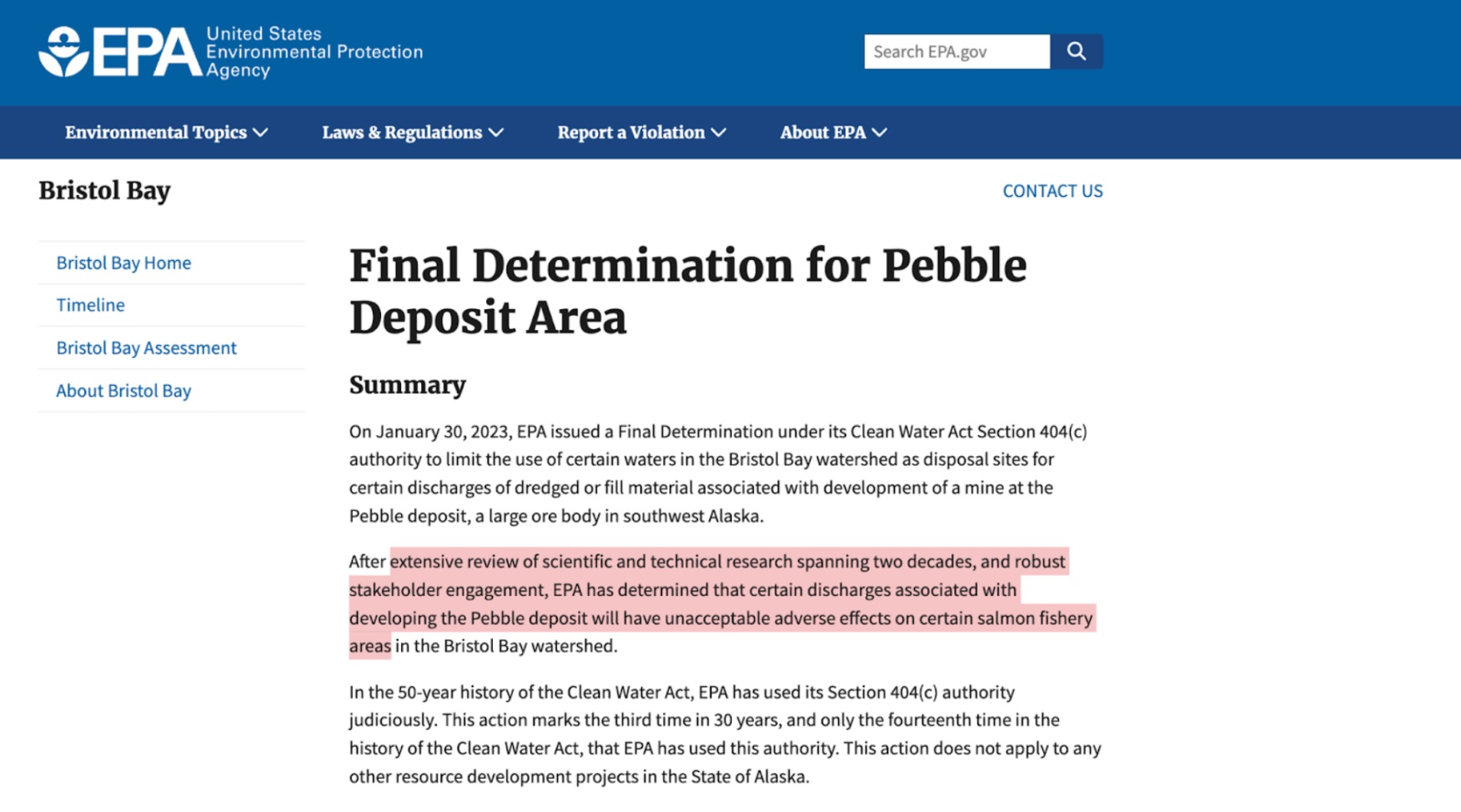

Consider the Alaskan Pebble Mine project, a promising source of copper as well as gold. After two decades of delays, in 2023 our EPA effectively canceled the project by deciding to withhold a crucial water permit.4

-

As bad as America’s mining situation is, our ability to process mined materials into useful ones is often worse.

E.g., for rare earth elements, which we used to lead, our only mine for years shipped its ore to China for processing (some now occurs domestically due to subsidies).5

-

The root cause of the decline of US mining and processing is the “green” movement that dominates our industrial policy. This movement holds that impacting nature is immoral, which means development—which is large-scale impacting of nature—is extra-immoral and should be stopped.

Our failure to encourage friendly trading partners

-

The more hostile America is toward industrial development of critical minerals, the more we depend on friendly trading partners, such as Canada and Australia. But we have not made it a priority to encourage these partners.

-

It’s no wonder that if the US is hostile to its own industrial development for critical minerals, it can’t be an effective advocate of increasing industrial development for critical minerals by allies. And Canada and Australia have their own anti-development “green” movements.

Our dangerous dependence on China

-

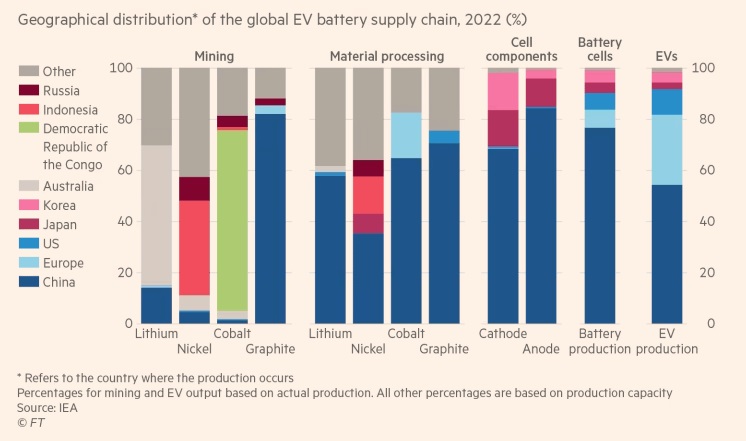

America's and our allies' hostility to the industrial freedom that mining and processing of critical minerals require has created a vacuum that others, above all China—in many ways our most threatening adversary—have been eager to fill.

-

China has strategically chosen to dominate the mining and processing of numerous critical minerals, including the rare earth elements used in LEDs, high-performance metal alloys, and electronics.

They have done this via rapid development at home and in partnering countries.

-

A major example of China’s commitment to rapid development of critical minerals is cobalt in Congo. While China doesn't mine cobalt, a mineral critical in battery production, it controls most of the mining in Congo, the world's dominant producer, via its strategic investments.6

-

It is clear that China has intentionally positioned its industries to create a choke point for critical technology industries, including military industries in Western countries.

Deng Xiaoping said as early as 1992: “The Middle East has its oil, China has rare earth.”7

-

China now has the ability to largely cut off the critical minerals we need both for our economy and for crucial military technologies—from high-performance jet engines and vehicle armor to missile guidance systems and semiconductors for communications equipment.

-

China, via critical minerals control, has effective veto power over the maintenance and expansion of our military power. And there is a real threat they will use it, as when they threatened to cut off rare earth exports to US defense manufacturers in 2019 over Taiwan.8

Making the problem worse through artificial demand

-

The same “green” movement that cripples domestic development of critical minerals is also trying to mandate rapid scaling of critical-mineral-hungry energy projects before supply chains are ready.

This is a disaster.

-

The push for “net zero by 2050” involves various government-mandated energy schemes that hinge on an unprecedented increase in the mining and processing of critical minerals that is somehow supposed to occur in today’s anti-development political environment.

-

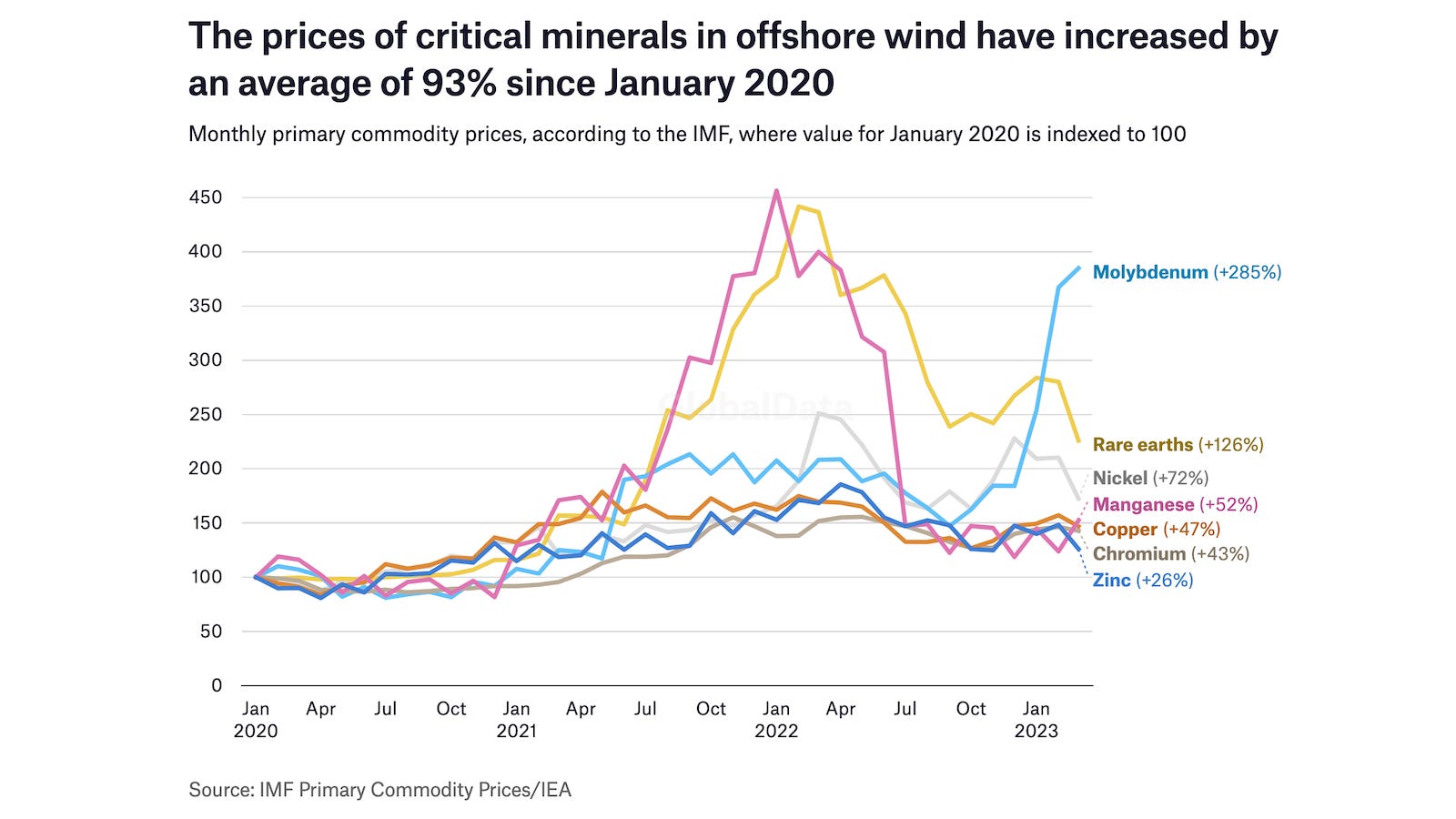

Note that even relatively mild increases in demand for critical minerals in recent years have led to scaling issues and cost increases—reversing a trend of falling prices that “green energy” advocates pretended would last forever.9

-

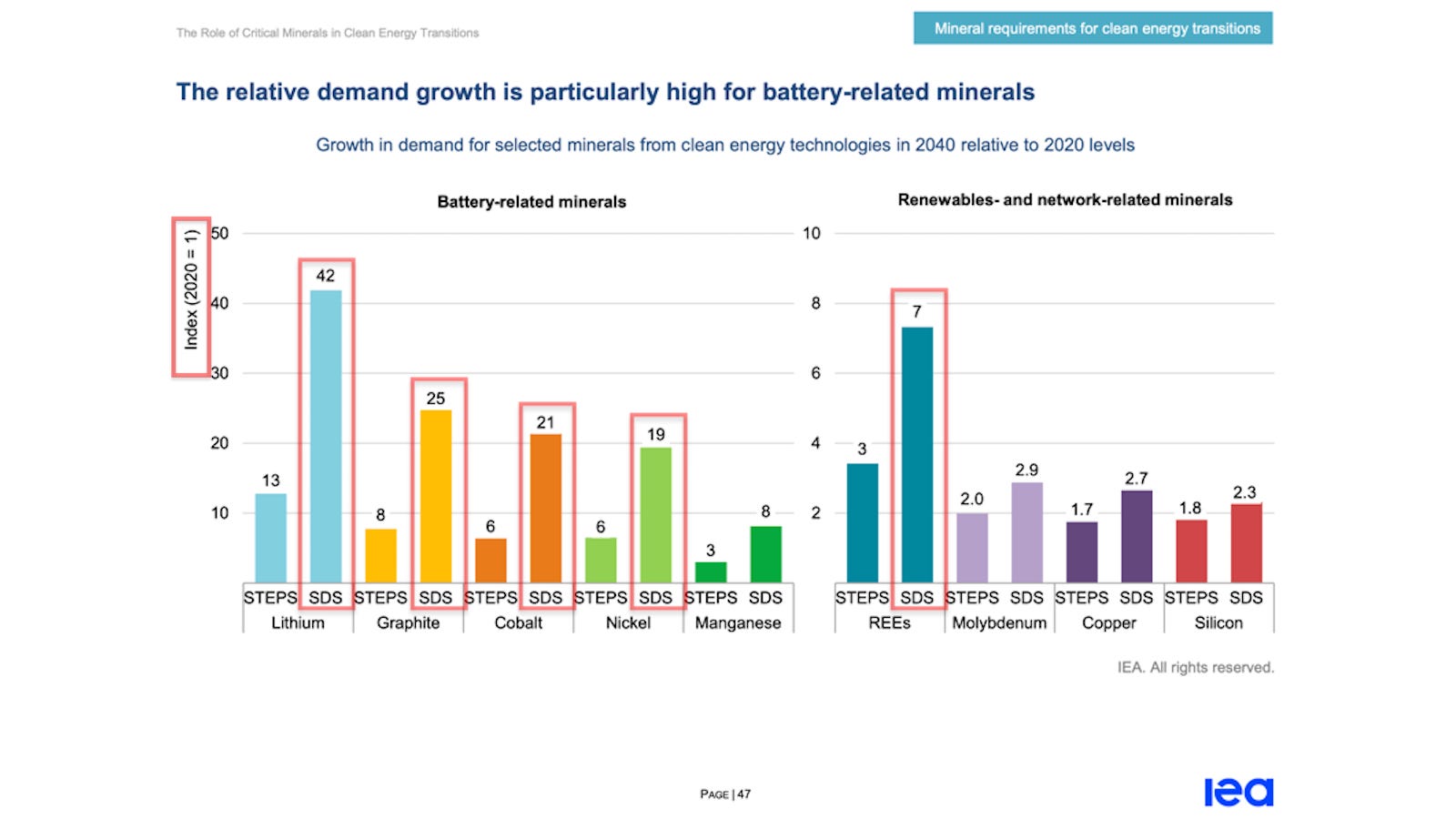

According to IEA, today’s “net zero by 2050” goal would require at least doubling supply of over half a dozen minerals per decade.

I know of no example of any major mined mineral doubling that fast, even with pro-development governments—let alone today's anti-development ones.10

Domestic subsidies are a false solution

-

Many leaders are waking up to the reality that we have allowed China to dominate supply chains on which our economy and security depend. Unfortunately, too many are focused not on liberating industrial development, but on subsidizing it.11

-

Committing to indefinite subsidies of US critical minerals industries is bad enough on its own, because it means committing to a higher cost of living. But to commit to indefinite subsidies of minerals and massively delay their development with “green” restrictions, is madness.

-

If the US determines that there is a true security threat that can only be resolved by temporarily having taxpayers pay to subsidize some domestic critical mineral, that is one thing. But long-term the only way to have a cost-effective domestic supply is industrial freedom.

Radical, pro-development policy reform is the only solution

-

Subsidies are not the answer. Neither are marginal reforms. We have to recognize that the critical minerals problem can only be solved by fixing the deeper problem: crisis-level restriction of domestic development.

-

America used to be able to build pipelines in months. The Empire State Building was built in a little over a year—using 1930s technology!

Today, China can radically upgrade a railway station in 9 hours. In America today you're lucky if you can upgrade a yoga studio in 9 months.12

-

We need leaders with the courage to deeply question today's anti-development policies, from the National Environmental Policy Act that adds years to projects to the Endangered Species Act that’s bad at preserving valuable species but good at destroying valuable projects.

-

Next time your elected official talks about valuing critical minerals, ask them what they're doing to truly liberate domestic development. Because only by liberating domestic development can we secure abundant energy and critical minerals for the future.

Steffen Henne and Michelle Hung contributed to this piece.

References

-

U.S. Geological Survey - 2022 final list of critical minerals↩

-

Visual Capitalist - How Mine Permitting Delays Impact the Transition to a Green Economy↩

-

Reuters - Biden administration kills Antofagasta's Minnesota copper project

Mining Technology - Twin Metals Minnesota (TMM) Mine, Minnesota↩

-

Mining.com - Only rare earths miner in US to bypass China in supply deal with Sumitomo

U.S. DoD - DoD Awards $35 Million to MP Materials to Build U.S. Heavy Rare Earth Separation Capacity↩

-

Financial Times - How China is winning the race for Africa’s lithium↩

-

The Heritage Foundation - Rare Earths Supply Chains and Confrontation With China↩

-

Financial Times - China targets rare earth export curbs to hobble US defence industry

NBC News - China sanctions 5 U.S. defense companies over Taiwan arms sales

Foreign Policy - China Raises Threat of Rare-Earths Cutoff to U.S.↩

-

Energy Monitor - Data shows how the cost of energy transition minerals has soared since 2020↩

-

IEA - The Role of Critical Minerals in Clean Energy Transitions

“Meeting such unprecedented mineral demands will require opening far more mines than now exist, and far faster than at any time in history. (The global average time from the qualification of a property to bringing a new mine into operation is 16 years.)”

Mark Mills - The “Energy Transition” Delusion A Reality Reset↩ -

U.S. DoD - DoD Awards $35 Million to MP Materials to Build U.S. Heavy Rare Earth Separation Capacity↩

-

The Empire State Building - Facts and Figures

Slate - The Story Behind That Viral Chinese Train Station Video↩