Skyrocketing oil and gasoline policies are not a failure of the oil industry. They are the total failure of anti-oil politicians, who have artificially restricted the supply of oil with massive restrictions and threats to oil production and transport.

Quick Summary

- Elizabeth Warren says gasoline prices are rising "because giant oil companies like Chevron and ExxonMobil enjoy doubling their profits." Joe Biden says "companies have not ramped up the supply of oil quickly enough."\

These anti-oil politicians should blame themselves instead.1

-

Contrary to rhetoric by Elizabeth Warren and others, oil and gasoline prices are not rising "because giant oil companies like Chevron and ExxonMobil enjoy doubling their profits." If oil companies could control prices they would have done so during often-unprofitable 2015-2020.2

-

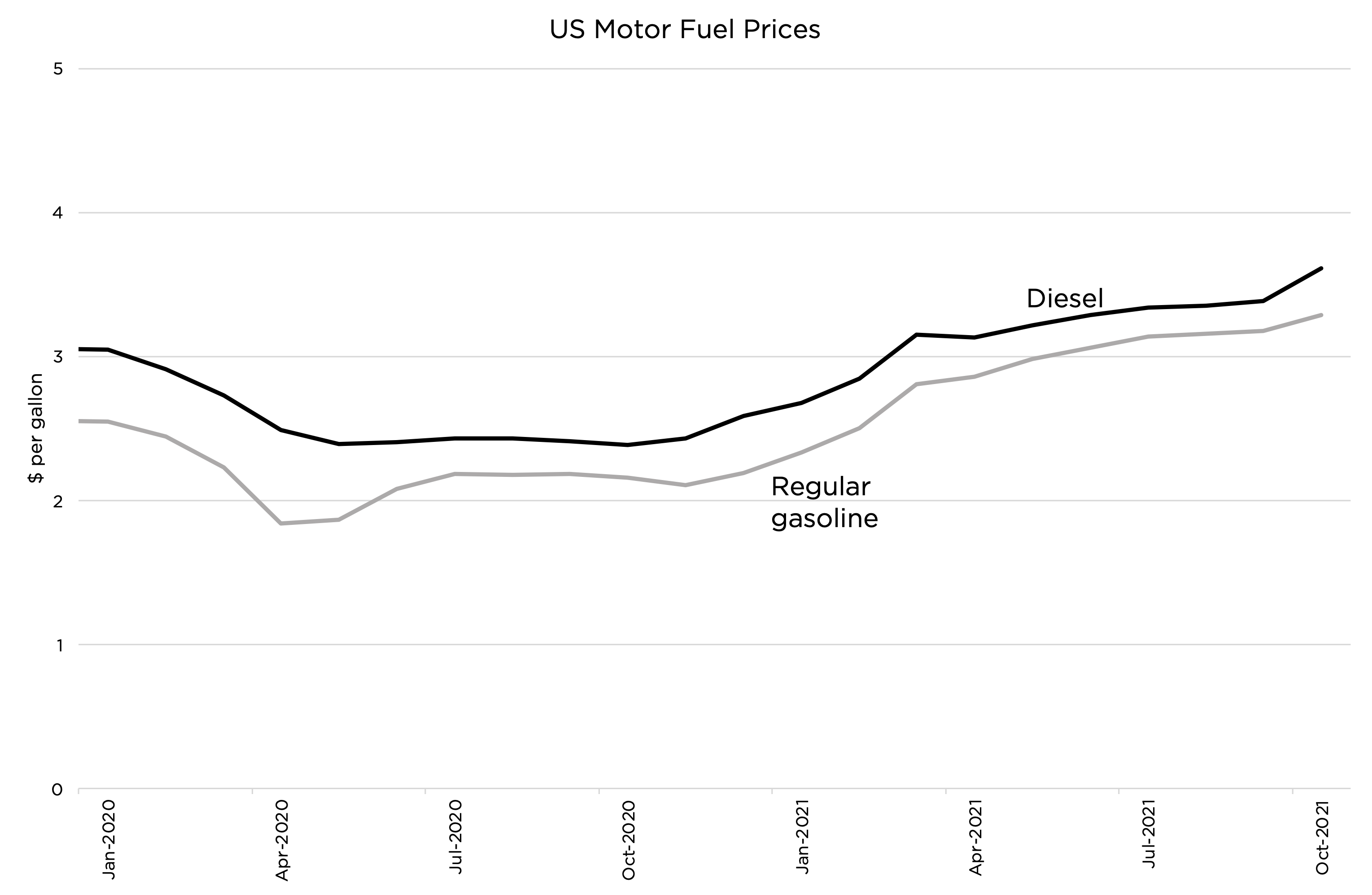

The most direct cause of rising prices is supply and demand. As our Energy Secretary says, "As we come out of an unprecedented global economic shutdown, oil supply has not kept up with demand." But why not? Because anti-oil policies have prevented supply from meeting demand.3

-

There is no physical reason the oil industry can't meet rising demand. The world has hundreds of years' worth of oil deposits. There is no technical reason the oil industry can't meet rising demand. It is more capable than ever thanks to amazing technologies like fracking.

-

If there is no physical or technical reason the oil industry can't meet rising demand, what is inhibiting it?\

Decades of rising restrictions on oil production and transport from anti-oil politicians--including Biden's massive threats to punish oil production going forward.4

-

Perhaps the greatest limiter of the supply of oil has been anti-oil politicians' constant threats to severely restrict or even ban oil production going forward. E.g., when Joe Biden promises "I will end fossil fuel" and then becomes President, oil investors run for the hills.5

-

Is it any wonder that, threatened with punishment, investment in oil and gas has declined dramatically? Between 2011 and 2021, oil and gas exploration investments declined by 50%. Less investment = less supply = higher prices.6

-

Anti-oil politicians' restrictions on infrastructure, especially pipelines, have reduced the supply of oil by making it difficult or impossible to transport US oil to international markets. If not for these restrictions we'd be producing more oil, with lower prices for everyone.

-

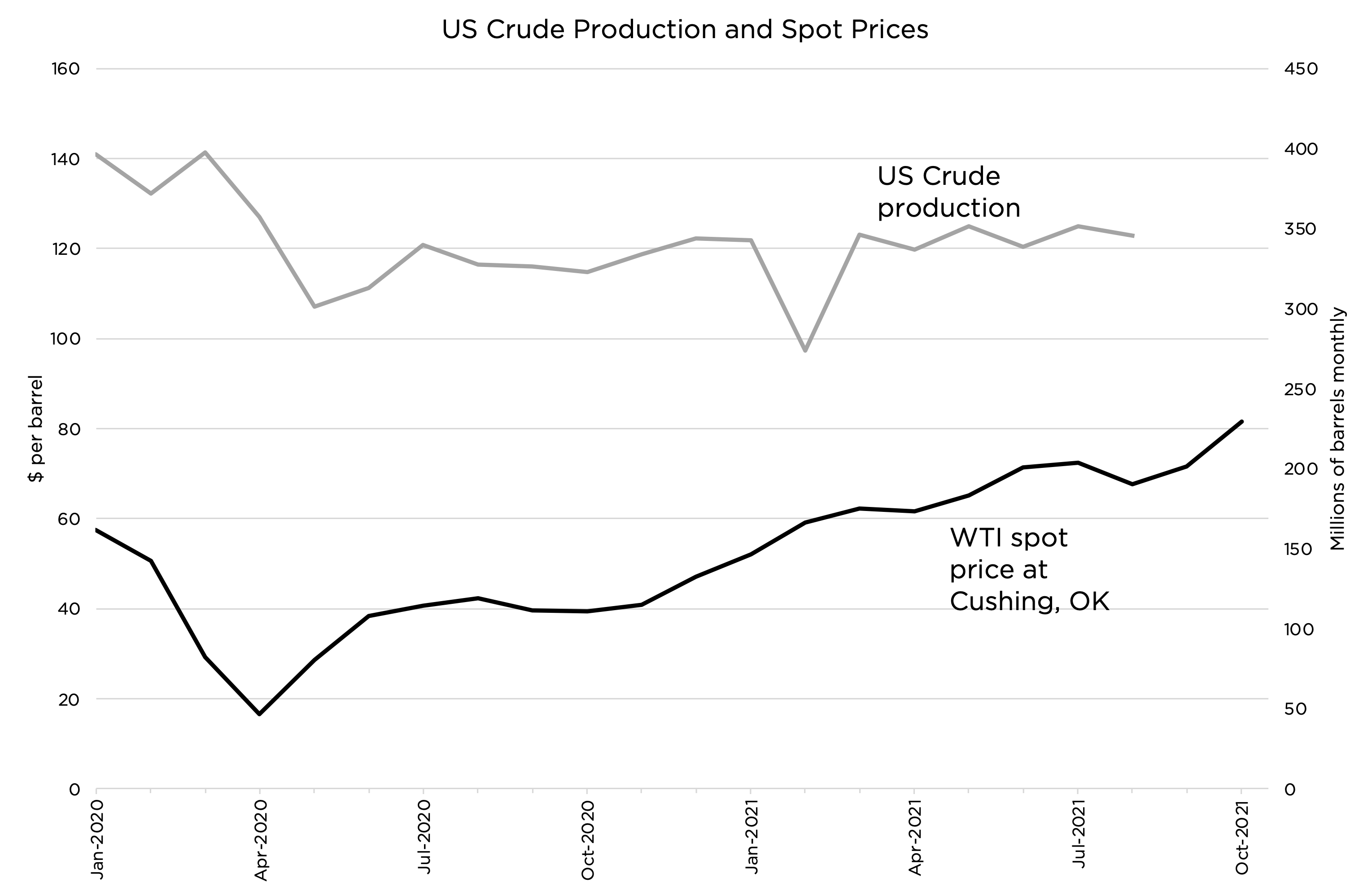

The dynamic US oil industry could be rapidly increasing production to take advantage of higher prices. But thanks to anti-oil politicians' threats to oil investors and infrastructure opposition, the US is ramping up production more slowly than OPEC!7

-

If not for Joe Biden and other anti-oil politicians around the world radically restricting the production/transport of oil, as well as threatening oil companies and investors, the global oil industry would have rapidly adjusted to rising demand—and prices would be far lower.

-

The cause-and-effect of unnecessarily high oil prices is simple:

- Anti-oil politicians around the world artificially restricted the supply of oil with massive restrictions/threats.

- These restrictions prevented supply from keeping up with demand, and prices went way up.

-

“Build Back Better,” aka "Make Everything Worse," promises to further restrict US oil production and increase prices via:

- new bans on offshore drilling,

- a costly methane tax that only applies to US production, and

- many other oil taxes and penalties.

It must be stopped.

References

- Senator Warren on Twitter

Reason - Elizabeth Warren Is Trying To Blame Inflation on 'Price Gouging.' Don't Buy It.

New York Post - Biden admits tapping oil reserve ‘won’t solve high gas prices overnight’

U.S. Energy Information Administration - Petroleum & Other Liquids, Weekly Retail Gasoline and Diesel Prices↩ - Michael Lynch - Estimating The Possible Decline Of U.S. Shale Oil Production With Lower Prices↩

- U.S. Department of Energy - DOE To Make Available A Release Of 50 Million Barrels Of Crude Oil From The Strategic Petroleum Reserve U.S. Energy Information Administration - Petroleum & Other Liquids, Spot Prices↩

- Wall Street Journal - Biden Has Been Wrong on Oil and Gas for Decades

CNBC - Biden administration proposes oil and gas drilling reform but stops short of ban

Elizabeth Warren Senate website - Senator Warren Statement on President's Executive Orders to Advance the Keystone XL and Dakota Access Pipelines

Institute for Energy Research - Biden Day 1 Executive Orders↩ - Breitbart - Joe Biden Promises Environmentalist: ‘Look into My Eyes; I Guarantee You, We Are Going to End Fossil Fuel’

Reuters - APPEC Lack of investment, more demand to drive oil price volatility -industry execs↩ - Financial Times - Embrace high fossil fuel prices because they are here to stay

Michael Shellenberger - How Climate Activists Caused the Global Energy Crisis↩ - OPEC - Monthly Oil Market Report, November 2021

U.S. Energy Information Administration - The U.S. leads global petroleum and natural gas production with record growth in 2018↩